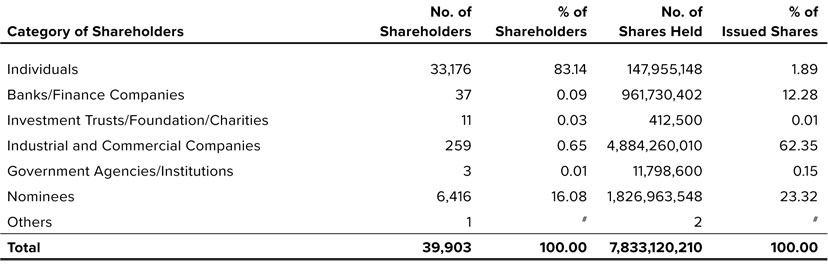

Shareholdings

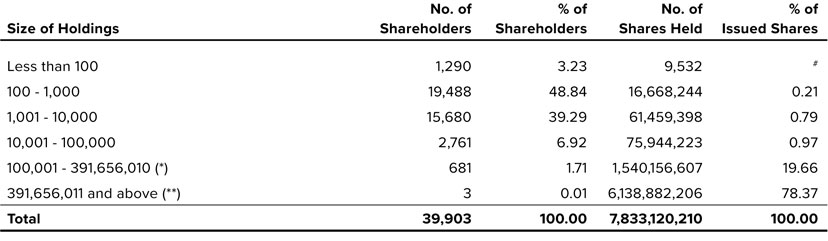

Size Of Shareholdings

As at 7 March 2025

SHARE CAPITAL

| Issued | : | 7,833,120,210 Ordinary Shares |

| Voting Right | : | One vote per Ordinary Share |

# Negligible

* Less than 5% of issued holdings

** 5% and above of issued holdings

Note:

Information in the above table is based on the Record of Depositors dated 7 March 2025.

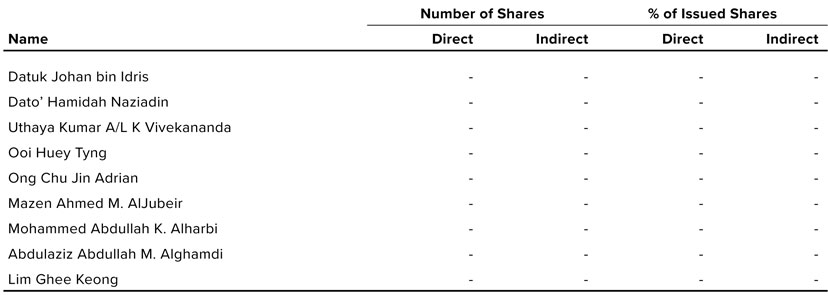

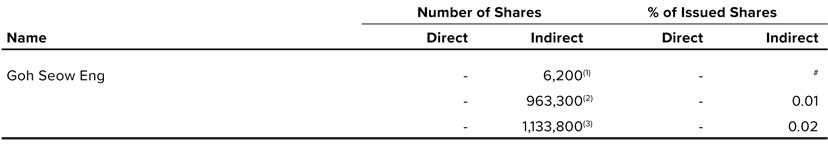

Chief Executive Officer's Interests in Shares

As at 7 March 2025

The interests of the Chief Executive Officer in the shares of the Company (both direct and indirect) as at 7 March 2025 are as follows:

# Negligible

Notes:

- (1) Deemed interest in shares of the Company held by spouse pursuant to Section 59(11)(c) of the CA 2016.

- (2) Pursuant to the terms and conditions of an incentive arrangement arising under the employment agreement entered by him and Maxis Broadband Sdn. Bhd., a wholly-owned subsidiary of Maxis (Agreement), a cash incentive was used to acquire shares of Maxis from the open market and such shares are currently held by CIMB Commerce Trustee Berhad (CIMB) or its nominee. These shares shall, subject to the satisfaction of the vesting conditions and the terms and conditions of the Agreement, vest in him on 30 June 2026. The vesting conditions comprise, amongst others, the performance targets for the financial years 2023, 2024 and 2025, as stipulated by Maxis' Nomination and Remuneration Committee.

- (3) Pursuant to the terms and conditions of an incentive arrangement arising under the Agreement, a cash incentive was used to acquire shares of Maxis from the open market and such shares are currently held by CIMB or its nominee. These shares shall, subject to the satisfaction of the vesting conditions and the terms and conditions of the Agreement, vest in him on 30 June 2027. The vesting conditions comprise, amongst others, the performance targets for the financial years 2024, 2025 and 2026, as stipulated by Maxis' Nomination and Remuneration Committee.

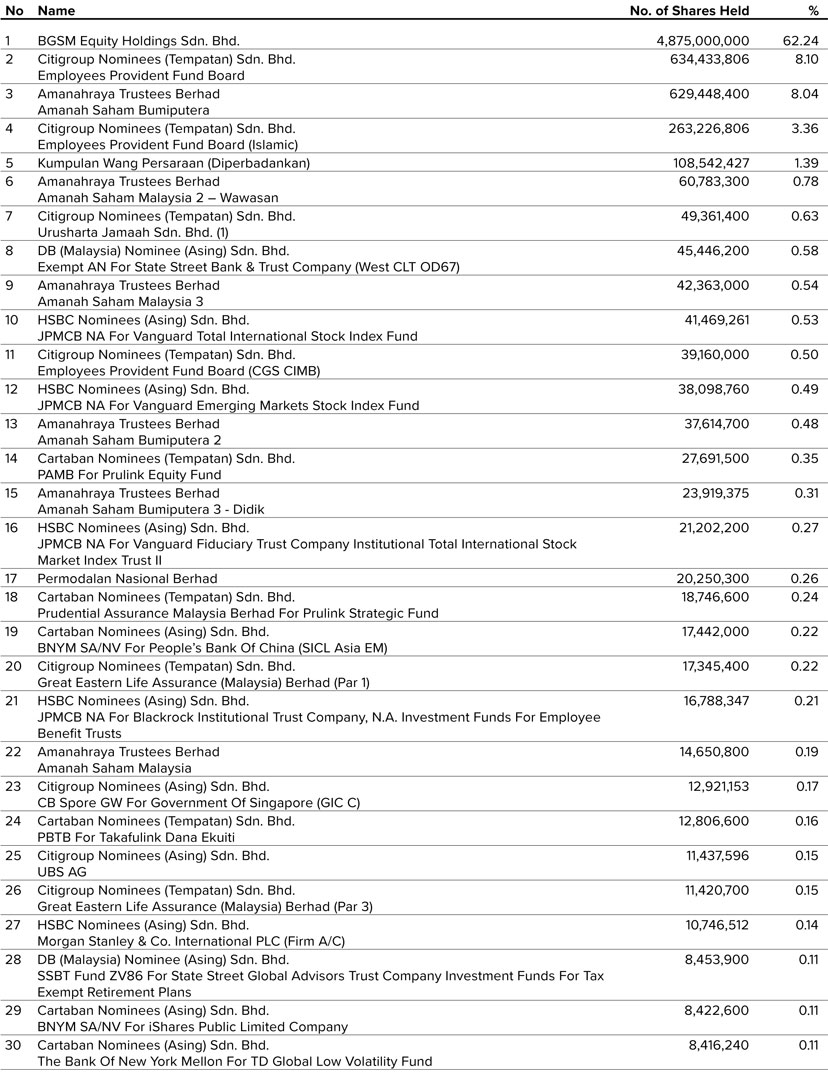

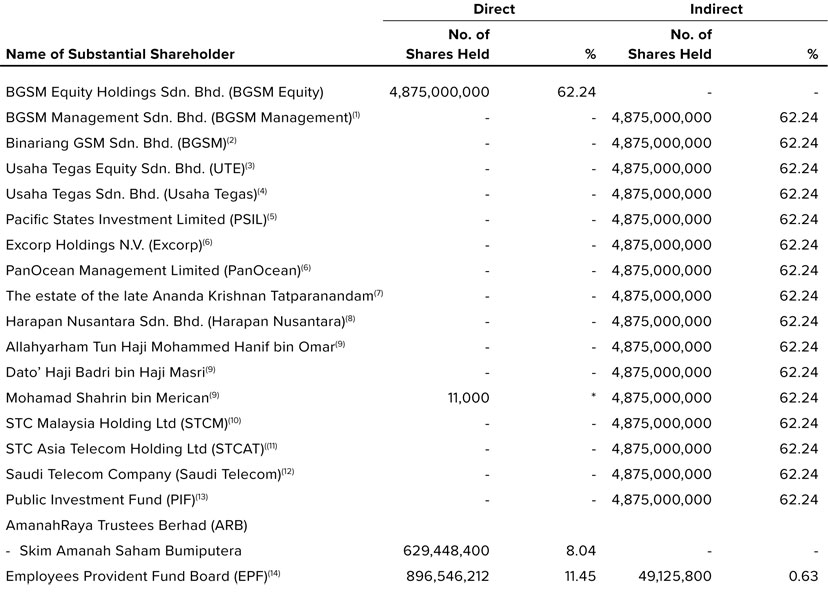

Information on Substantial Shareholders

As at 7 March 2025

The shareholders holding more than 5% interest, direct and indirect, in the ordinary shares in Maxis (Shares) based on the Register of Substantial Shareholders of the Company as at 7 March 2025 are as follows:

Notes:

- # Negligible

- (1) BGSM Management's deemed interest in the Shares arises by virtue of BGSM Management holding 100% equity interest in BGSM Equity.

- (2) BGSM's deemed interest in the Shares arises by virtue of BGSM holding 100% equity interest in BGSM Management. See Note (1) above for BGSM Management's deemed interest in the Shares.

- (3) UTE's deemed interest in the Shares arises through its wholly-owned subsidiaries, namely, Wilayah Resources Sdn. Bhd., Tegas Puri Sdn. Bhd., Besitang Barat Sdn. Bhd. and Besitang Selatan Sdn. Bhd. which hold in aggregate 37% equity interest in BGSM. See Note (2) above for BGSM's deemed interest in the Shares.

- (4) Usaha Tegas' deemed interest in the Shares arises by virtue of Usaha Tegas holding 100% equity interest in UTE. See Note (3) above for UTE's deemed interest in the Shares. See Note (3) above for UTE's deemed interest in the Shares.

- (5) PSIL's deemed interest in the Shares arises by virtue of PSIL holding 99.999% equity interest in Usaha Tegas. See Note (4) above for Usaha Tegas' deemed interest in the Shares.

- (6) PanOcean holds 100% equity interest in Excorp which in turn holds 100% equity interest in PSIL. See Note (5) above for PSIL's deemed interest in the Shares. PanOcean is the trustee of a discretionary trust, the beneficiaries of which are members of the family of the late Ananda Krishnan Tatparanandam (TAK) and foundations including those for charitable purposes. Although PanOcean is deemed to have an interest in such Shares, PanOcean does not have any economic or beneficial interest in such Shares, as such interest is held subject to the terms of such discretionary trust.

- (7) The estate of TAK's deemed interest in the Shares arises by virtue of PanOcean's deemed interest in the Shares. See Note (6) above for PanOcean's deemed interest in the Shares. Although the estate of TAK is deemed to have an interest in such Shares, it does not have any economic or beneficial interest in such Shares, as such interest is held subject to the terms of a discretionary trust referred to in Note (6) above.

- (8) Harapan Nusantara's deemed interest in the Shares arises through its wholly-owned subsidiaries, namely, Mujur Anggun Sdn. Bhd., Cabaran Mujur Sdn. Bhd., Anak Samudra Sdn. Bhd., Dumai Maju Sdn. Bhd., Nusantara Makmur Sdn. Bhd., Usaha Kenanga Sdn. Bhd. and Tegas Sari Sdn. Bhd. (collectively, “Harapan Nusantara Subsidiaries”), which hold in aggregate 30% equity interest in BGSM. See Note (2) above for BGSM's deemed interest in the Shares. The Harapan Nusantara Subsidiaries hold their deemed interest in such Shares under discretionary trusts for Bumiputera objects. As such, Harapan Nusantara does not have any economic interest in such Shares as such interest is held subject to the terms of such discretionary trusts.

- (9) His deemed interest in the Shares arises by virtue of his 25% direct equity interest in Harapan Nusantara. However, he does not have any economic interest in such Shares as such interest is held subject to the terms of the discretionary trusts referred to in Note (8) above.

- (10) STCM's deemed interest in the Shares arises by virtue of STCM holding 25% equity interest in BGSM. See Note (2) above for BGSM's deemed interest in the Shares.

- (11) STCAT's deemed interest in the Shares arises by virtue of STCAT holding 100% equity interest in STCM. See Note (10) above for STCM's deemed interest in the Shares.

- (12) Saudi Telecom's deemed interest in the Shares arises by virtue of Saudi Telecom holding 100% equity interest in STCAT. See Note (11) above for STCAT's deemed interest in the Shares.

- (13) PIF's deemed interest in the Shares arises by virtue of PIF's controlling interest in Saudi Telecom. See Note (12) above for Saudi Telecom's deemed interest in the Shares.

- (14) EPF is deemed to have an interest in 49,125,800 Shares held through nominees.