Maxis Berhad

Annual Report 2015

page

164

Notes to the Financial Statements

31 December 2015

33 FINANCIAL RISK MANAGEMENT (CONTINUED)

(c) Liquidity risk (continued)

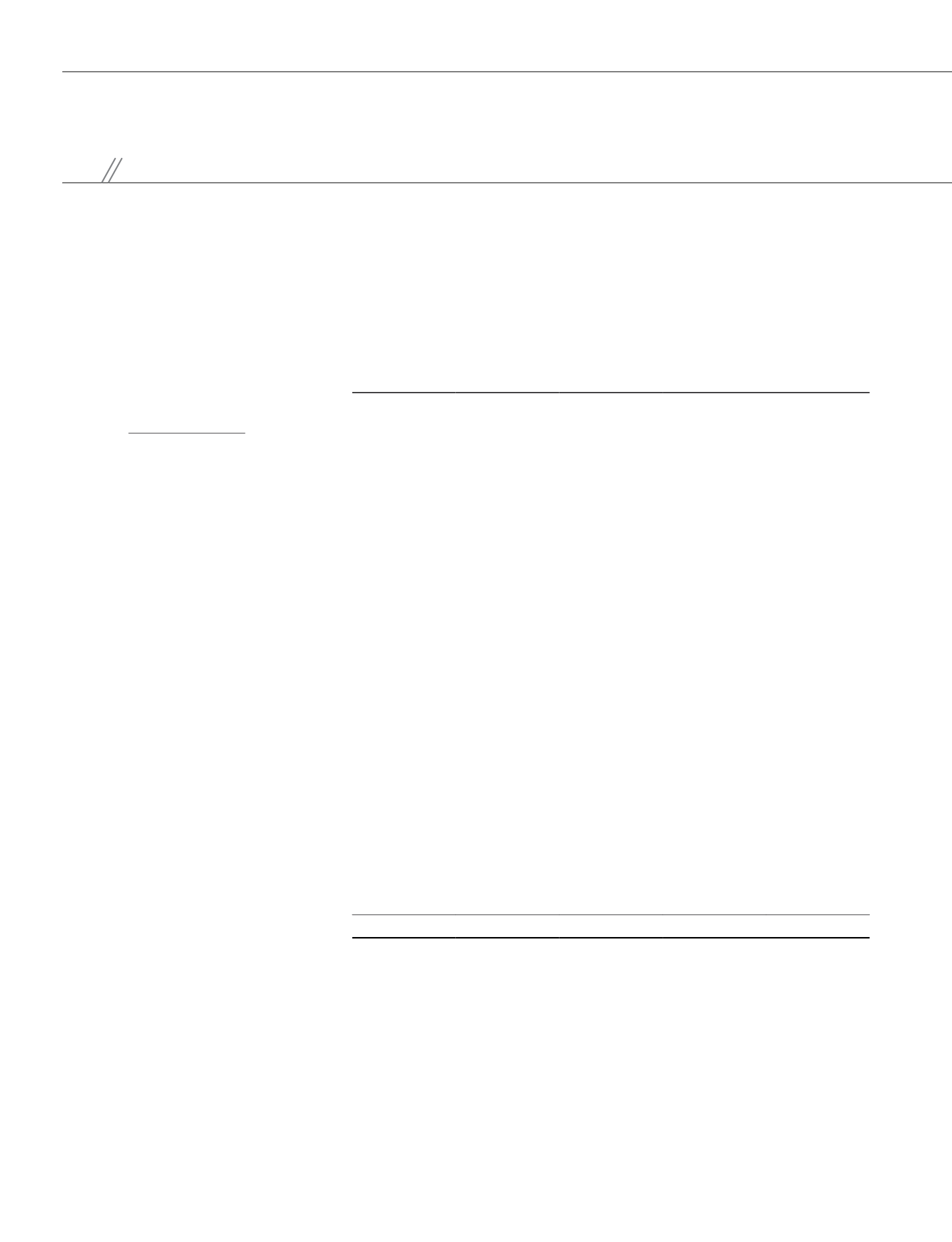

The undiscounted contractual cash flow payables under the financial instruments as at the reporting date are as follows: (continued)

Group

Total

(1)

RM’000

< 1 year

RM’000

1-2 years

RM’000

2-5 years

RM’000

> 5 years

RM’000

At 31 December 2014

Payables and accruals

(2)

- principal

2,248,017

1,799,117

108,423

292,722

47,755

- interest

(3)

41,891

13,624

10,895

16,752

620

Amounts due to fellow subsidiaries

487

487

-

-

-

Amounts due to related parties

24,429

24,429

-

-

-

Loan from a related party

- principal

28,875

28,875

-

-

-

- interest

(3)

2,130

2,130

-

-

-

Finance lease liabilities

28,413

15,555

7,589

5,269

-

Bank borrowings

(2)

- principal

4,338,510

865,879

865,879

459,178

2,147,574

- interest

(3)

565,770

98,245

84,459

211,589

171,477

Islamic Medium Term Notes

- nominal value

2,450,000

-

-

-

2,450,000

- profit

(3)

919,925

122,500

122,836

367,500

307,089

Commodity Murabahah Term Financing

- nominal value

2,150,000

-

-

-

2,150,000

- profit

(3)

979,581

103,565

103,849

310,695

461,472

Net settled derivative financial

instruments (CCIRS and IRS)

(2)(3)

40,078

55,044

28,584

66,775

(110,325)

13,818,106

3,129,450

1,332,514

1,730,480

7,625,662

Notes:

(1)

As the amounts included in the table are the contractual undiscounted cash flows, these amounts will not reconcile with the amounts disclosed in the statements of financial position.

(2)

Foreign currency denominated financial instruments are translated to RM using closing rate as at the reporting date.

(3)

Based on contractual interest rates/profit margin as at the reporting date.