Maxis Berhad

Annual Report 2015

page

162

Notes to the Financial Statements

31 December 2015

33 FINANCIAL RISK MANAGEMENT (CONTINUED)

(a) Market risk (continued)

(ii)

Interest rate risk (continued)

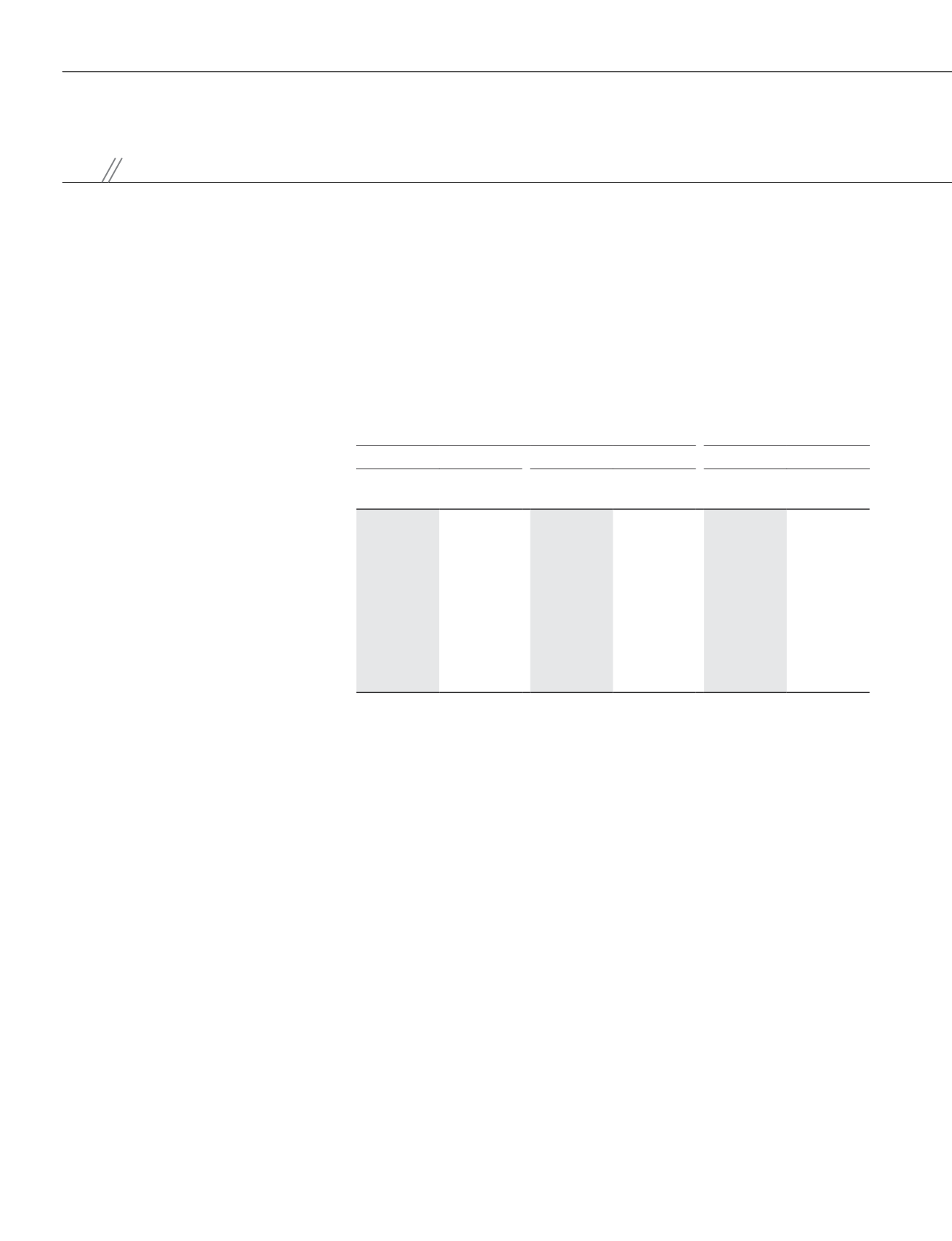

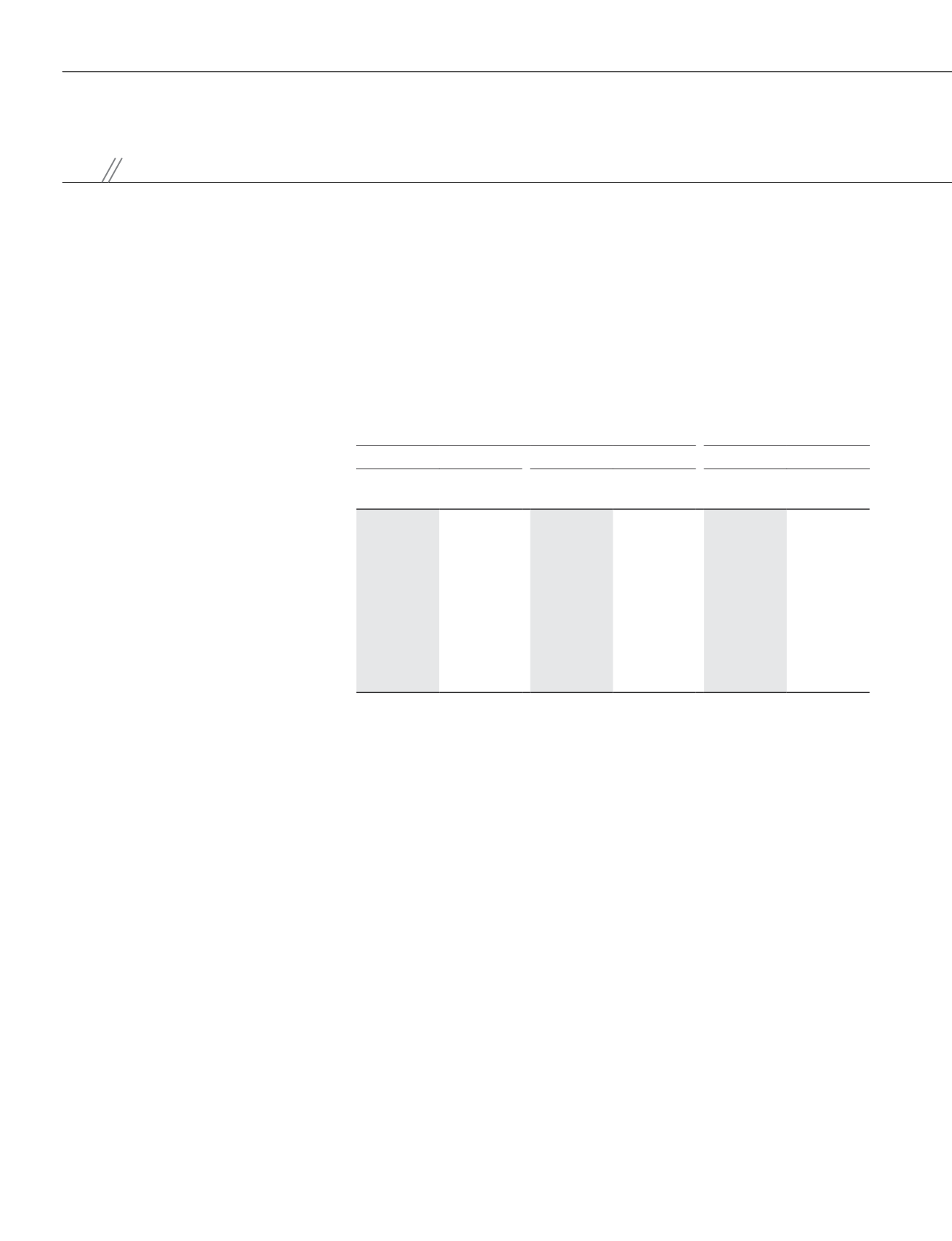

The sensitivity of the Group’s and of the Company’s profit before tax for the financial year and equity to a reasonably possible change

in RM and USD interest rates with all other factors held constant and based on composition of liabilities with floating interest rates at

the reporting date are as follows:

Impact on profit before tax for the financial year

Impact on equity

(1)

Group

Company

Group and Company

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

RM

- increased by 0.5% (2014: 0.5%)

(14,077)

(14,958)

(12,727)

(16,958)

17,787

20,345

- decreased by 0.5% (2014: 0.5%)

14,077

14,958

12,727

16,958

(17,787)

(20,345)

USD

- increased by 0.5% (2014: 0.5%)

(2,756)

(2,787)

-

-

21,877

26,815

- decreased by 0.5% (2014: 0.5%)

2,756

2,787

-

-

(21,877)

(26,815)

Note:

(1)

Represents cash flow hedging reserve

The impacts on profit before tax for the financial year are mainly as a result of interest expenses/income on floating rate payables, loan

from a related party and borrowings not in a designated hedging relationship. For borrowings in a designated hedging relationship, as

these are effectively hedged, the interest rate movements will not have any impact on the statement of profit or loss.

(b) Credit risk

The objectives of the Group’s and of the Company’s credit risk management policies are to manage their exposure to credit risk from

deposits, cash and bank balances, receivables, derivative financial instruments and inter-company loans. They do not expect any third

parties to fail to meet their obligations given the Group’s and the Company’s policies of selecting creditworthy counterparties.

The Group has no significant concentration of credit risk as the Group’s policy limits the concentration of financial exposure to any single

counterparty. Credit risk of trade receivables is controlled by the application of credit approvals, limits and monitoring procedures. Credit

risks are minimised and monitored via limiting the Group’s dealings with creditworthy business partners and customers. Trade receivables

are monitored on an ongoing basis via the Group’s management reporting procedures. At the Company level, inter-company loans exposure

to bad debts is not significant since the subsidiaries do not have historical default.

For deposits, cash and bank balances, the Group and the Company seek to ensure that cash assets are invested safely and profitably by

assessing counterparty risks and allocating placement limits for various creditworthy financial institutions. As for derivative financial

instruments, the Group and the Company enter into the contracts with various reputable counterparties to minimise the credit risks. The

Group and the Company consider the risk of material loss in the event of non-performance by the above parties to be unlikely. The Group’s

and the Company’s maximum exposure to credit risk is equal to the carrying value of those financial instruments.