Maxis Berhad

Annual Report 2015

page

158

Notes to the Financial Statements

31 December 2015

33 FINANCIAL RISK MANAGEMENT (CONTINUED)

(a) Market risk (continued)

(ii)

Interest rate risk (continued)

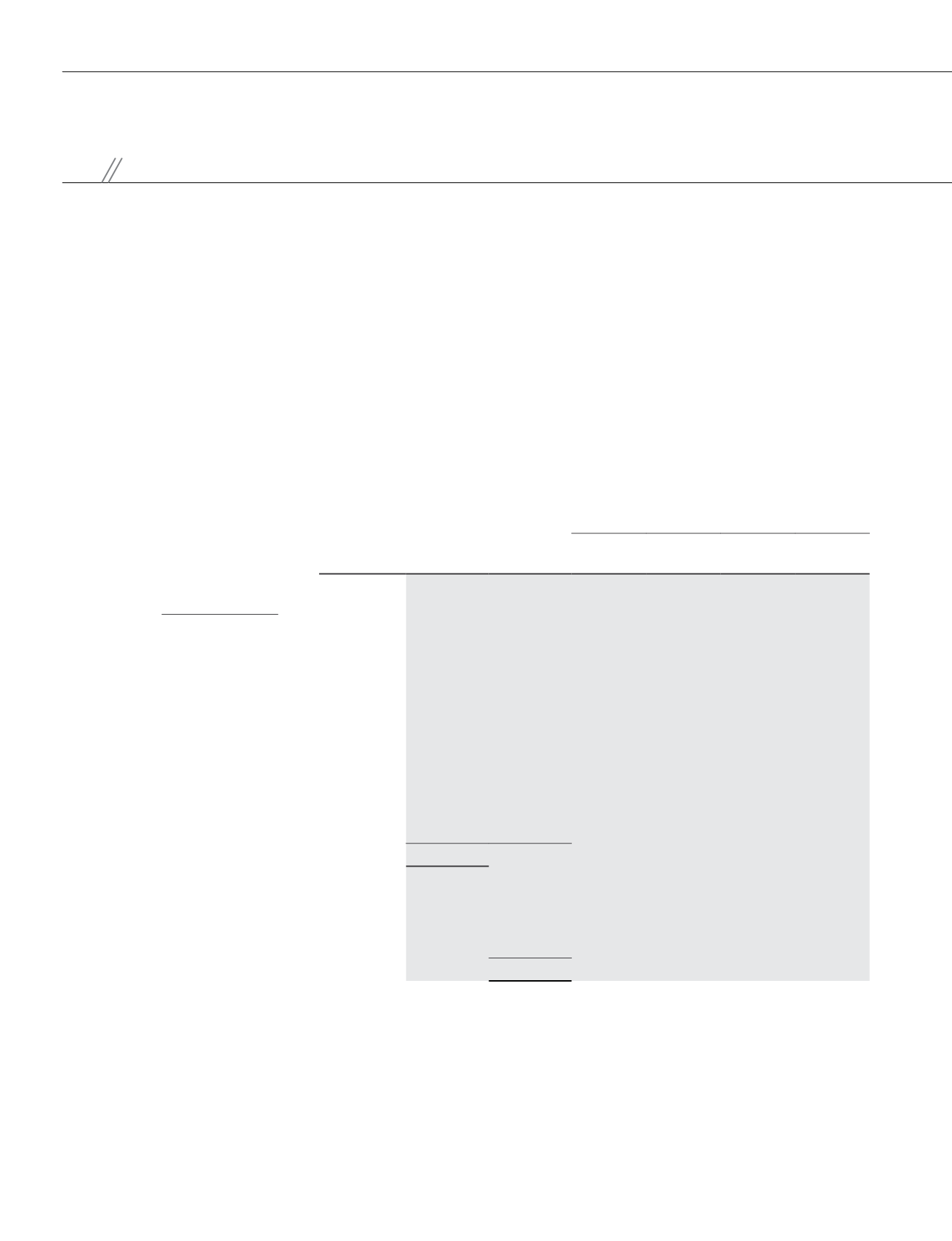

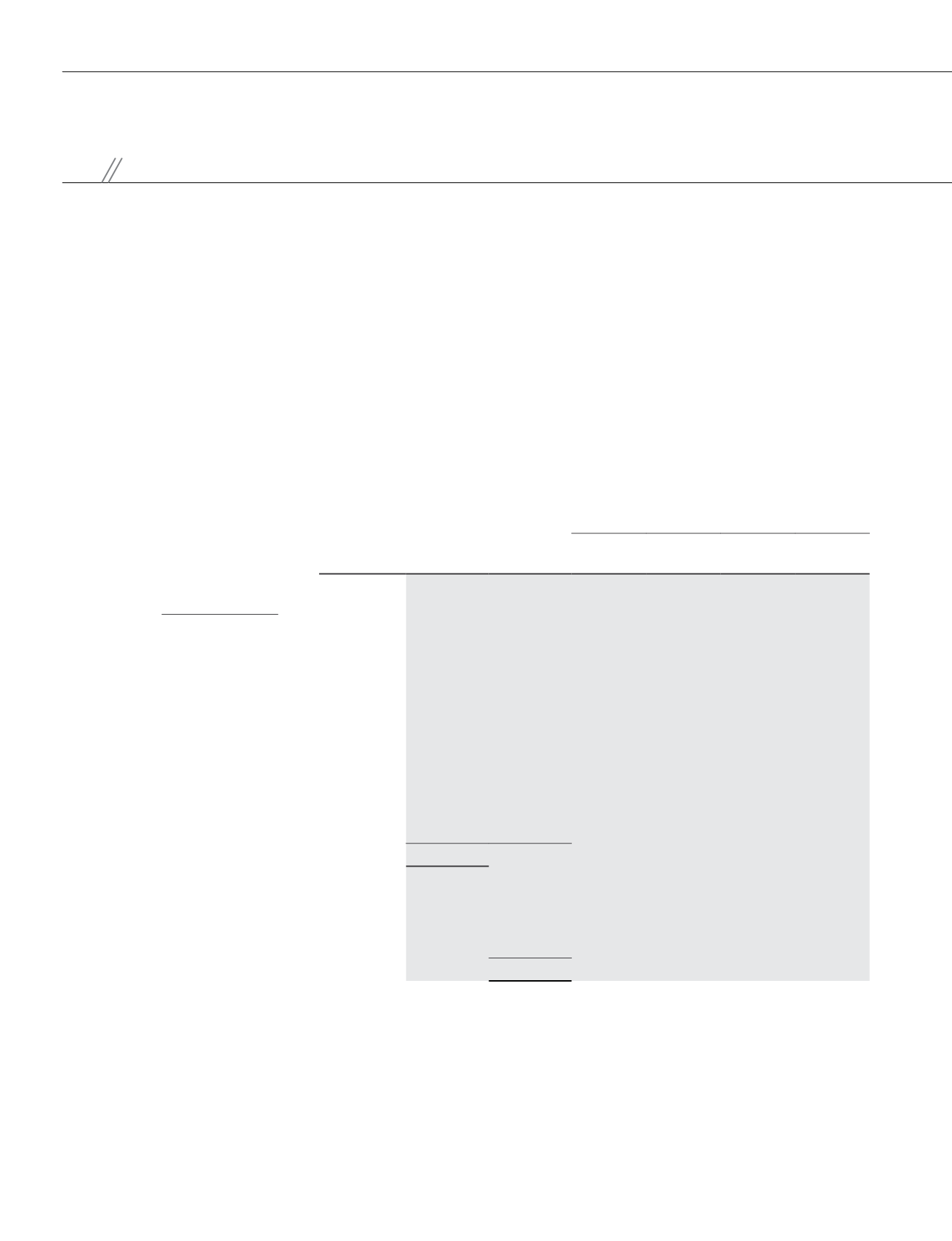

The net exposure of financial assets and financial liabilities of the Group and of the Company to interest rate risk (before and after

taking effect of cross currency interest rate swap and interest rate swap contracts) and the periods in which the borrowings mature

or reprice (whichever is earlier) are as follows:

Group

Weighted

average

effective

interest rate/

profit margin at

reporting date

(per annum)

%

Total

carrying

amount

RM’000

Floating

interest

rate

< 1 year

RM’000

Fixed interest rate/profit margin

< 1 year

RM’000

1-2 years

RM’000

2-5 years

RM’000

> 5 years

RM’000

At 31 December 2015

Deposits with licensed banks

4.13 1,123,583

- 1,123,583

-

-

-

Trade payables

3.00 (551,101)

(551,101)

-

-

-

-

Finance lease liabilities

10.00 (20,848)

-

(12,868)

(6,134)

(1,846)

-

Syndicated term loans

2.00 (2,055,764) (2,055,764)

-

-

-

-

Term loans

3.62 (1,959,327) (1,959,327)

-

-

-

-

Islamic Medium Term Notes

5.10 (3,325,483)

-

-

-

- (3,325,483)

Commodity Murabahah

Term Financing

4.87 (2,516,230) (2,516,230)

-

-

-

-

Loan from a related party

7.85

(29,012)

(29,012)

-

-

-

-

Gross exposure

(9,334,182) (7,111,434)

CCIRS and IRS:

- syndicated term loans

4.85

2,055,764 (1,064,080) (563,561) (428,123)

-

- term loans

4.52

1,020,188

-

-

- (1,020,188)

Net exposure

(4,035,482)