Overview Our Business

Strategic Review Corporate Governance

Financial Statements

Other Information

page

157

Notes to the Financial Statements

31 December 2015

33 FINANCIAL RISK MANAGEMENT (CONTINUED)

(a) Market risk (continued)

(i)

Foreign exchange risk (continued)

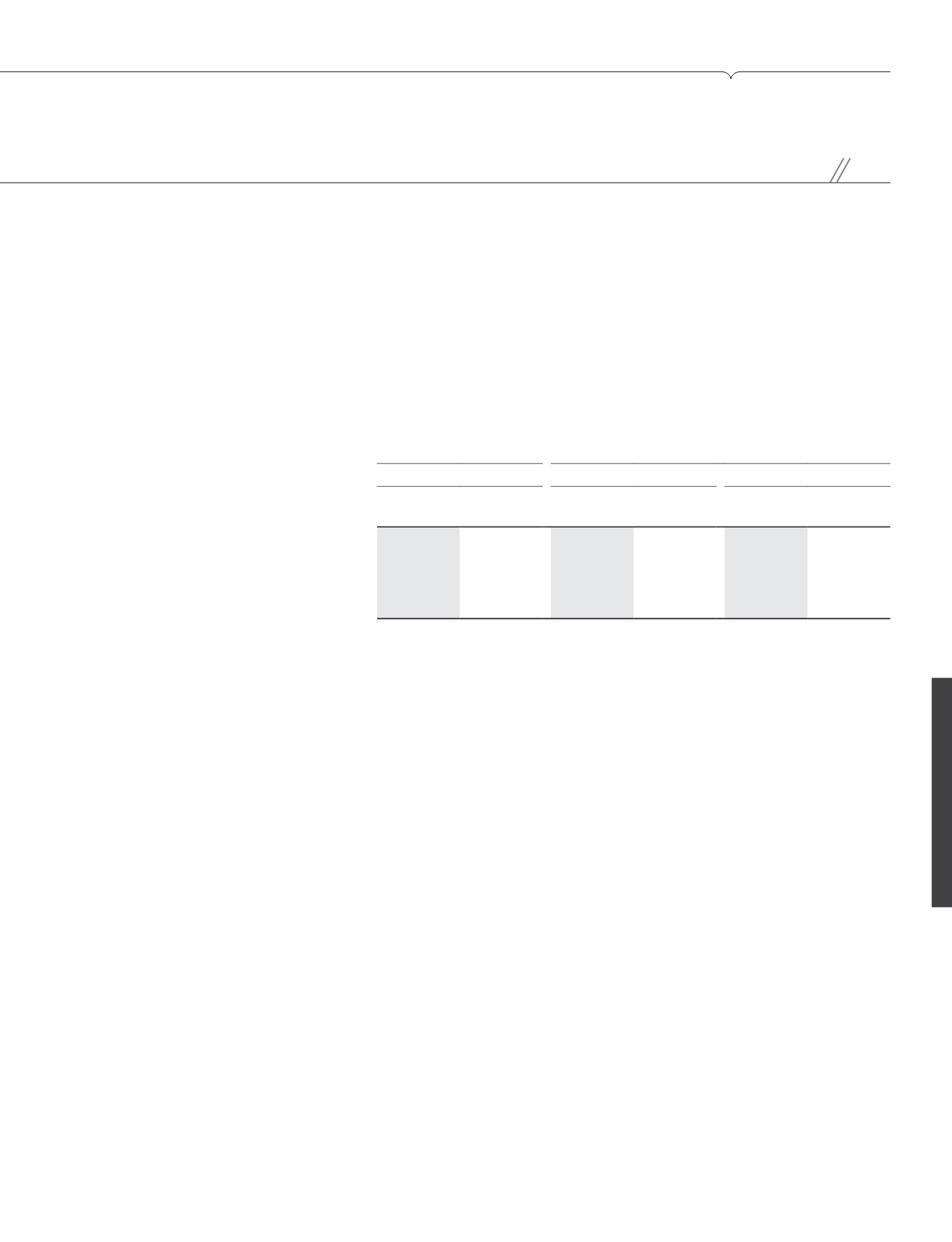

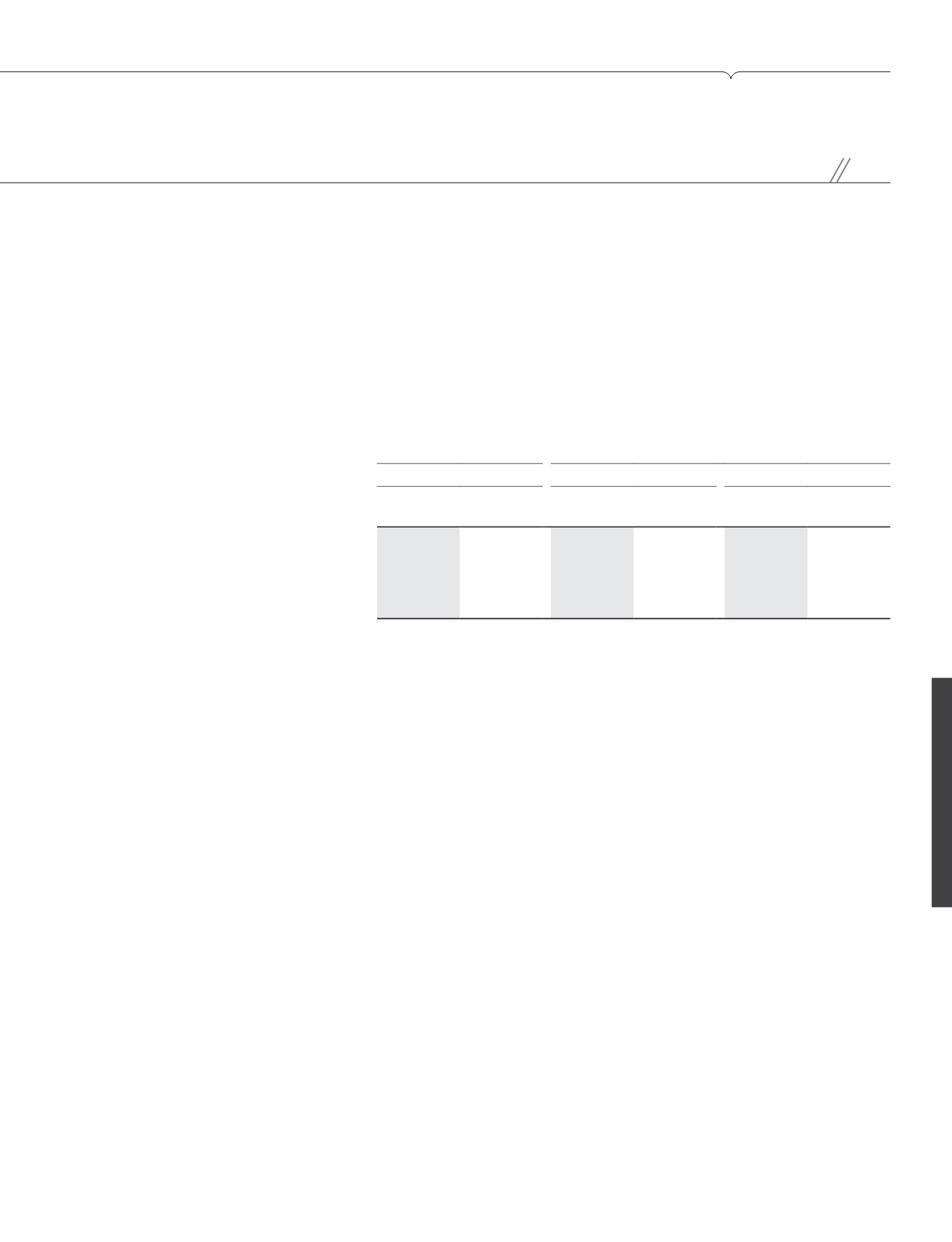

The sensitivity of the Group’s and of the Company’s profit before tax for the financial year and equity to a reasonably possible change

in the USD exchange rate against the Group’s and the Company’s functional currency, RM, with all other factors remaining constant

and based on the composition of assets and liabilities at the reporting date are set out as below.

Impact on profit before tax

for the financial year

Impact on equity

(1)

Group

Group

Company

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

USD/RM

- strengthened 5% (2014: 5%)

(34,769)

(31,845)

8,437

6,785

5,655

6,785

- weakened 5% (2014: 5%)

34,769

31,845

(8,437)

(6,785)

(5,655)

(6,785)

Note:

(1)

Represents cash flow hedging reserve

The impacts on profit before tax for the financial year are mainly as a result of foreign currency gains/losses on translation of USD

denominated receivables, deposits, bank balances and unhedged payables. For USD borrowings and payables in a designated hedging

relationship, as these are effectively hedged, the foreign currency movements will not have any impact on the statement of profit or loss.

(ii)

Interest rate risk

The Group’s and the Company’s interest rate risk arises from deposits with licensed banks, deferred payment creditors, borrowings,

loan from a related party and inter-company loans carrying fixed and variable interest rates. The objectives of the Group’s and of the

Company’s interest rate risk management policies are to allow the Group and the Company to effectively manage the interest rate

fluctuation through the use of fixed and floating interest rates debt and derivative financial instruments. The Group and the Company

adopt a non-speculative stance which favours predictability over interest rate fluctuations. The interest rate profiles of the Group’s

and of the Company’s borrowings are also regularly reviewed against prevailing and anticipated market interest rates to determine

whether refinancing or early repayment is warranted.

The Group and the Company manage their cash flow interest rate risk by using cross currency interest rate swap contracts and

interest rate swap contracts. Such swaps have the economic effect of converting certain borrowings from floating rates to fixed rates.