Maxis Berhad

Annual Report 2015

page

168

Notes to the Financial Statements

31 December 2015

33 FINANCIAL RISK MANAGEMENT (CONTINUED)

(e) Fair value estimation

Fair values are categorised into different levels in a fair value hierarchy based on the inputs used in the valuation techniques as follows:

Level 1:

quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2:

inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly

(i.e. as prices) or indirectly (i.e. derived from prices).

Level 3:

inputs for the asset or liability that are not based on observable market data (unobservable inputs).

(i)

Financial instruments carried at amortised cost

The carrying amounts of financial assets and liabilities of the Group and of the Company at the reporting date approximated their fair

values except as set out below measured using Level 3 valuation technique:

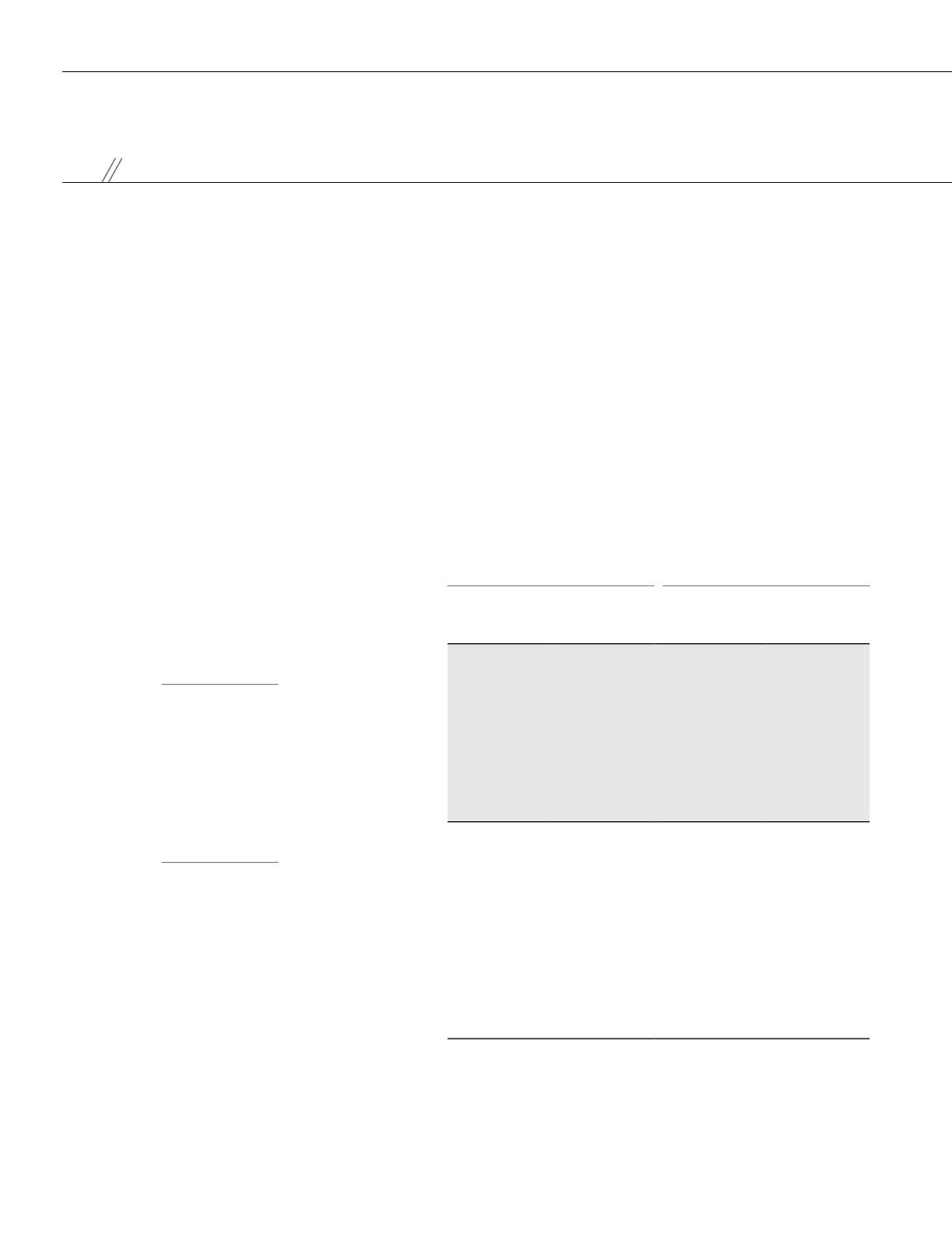

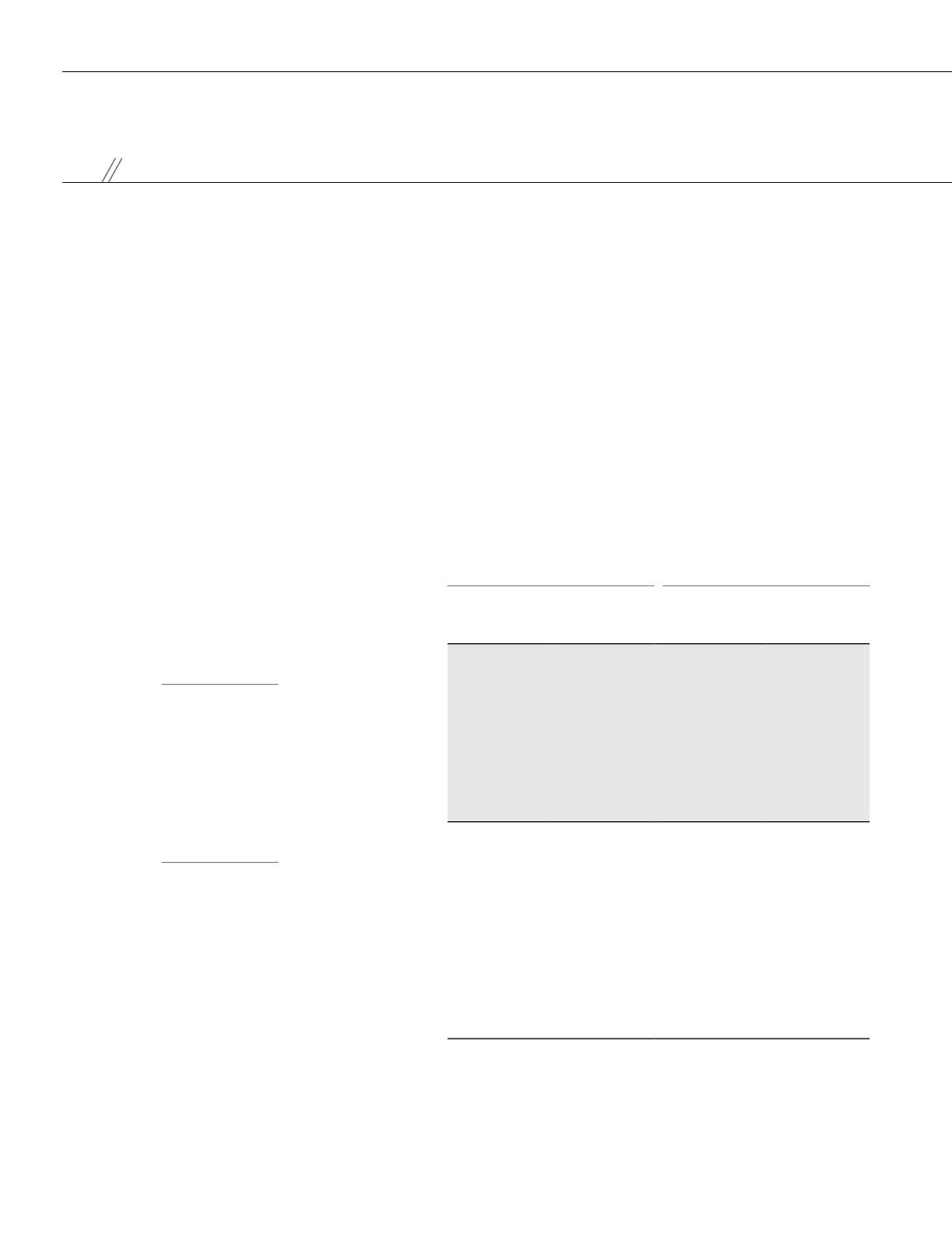

Group

Company

Note

Carrying

amount

RM’000

Fair

value

RM’000

Carrying

amount

RM’000

Fair

value

RM’000

At 31 December 2015

Financial liability:

Borrowings

- finance lease liabilities

30(a)

7,980

6,731

-

-

- Islamic Medium Term Notes

(Sukuk Musharakah)

2,485,513

2,449,777

2,485,513

2,449,777

At 31 December 2014

Financial asset:

Loan to a subsidiary

17

-

-

1,205,763

1,189,095

Financial liability:

Borrowings

- finance lease liabilities

30(a)

11,855

9,602

-

-

- Islamic Medium Term Notes

30(d)

2,484,105

2,502,657

2,484,105

2,502,657

The valuation technique used to derive the Level 3 disclosure for financial asset is based on the estimated cash flow and discount

rate of the underlying counterparty while financial liability is based on the estimated cash flow and discount rate of the Group and

the Company.