Overview Our Business

Strategic Review Corporate Governance

Financial Statements

Other Information

page

145

Notes to the Financial Statements

31 December 2015

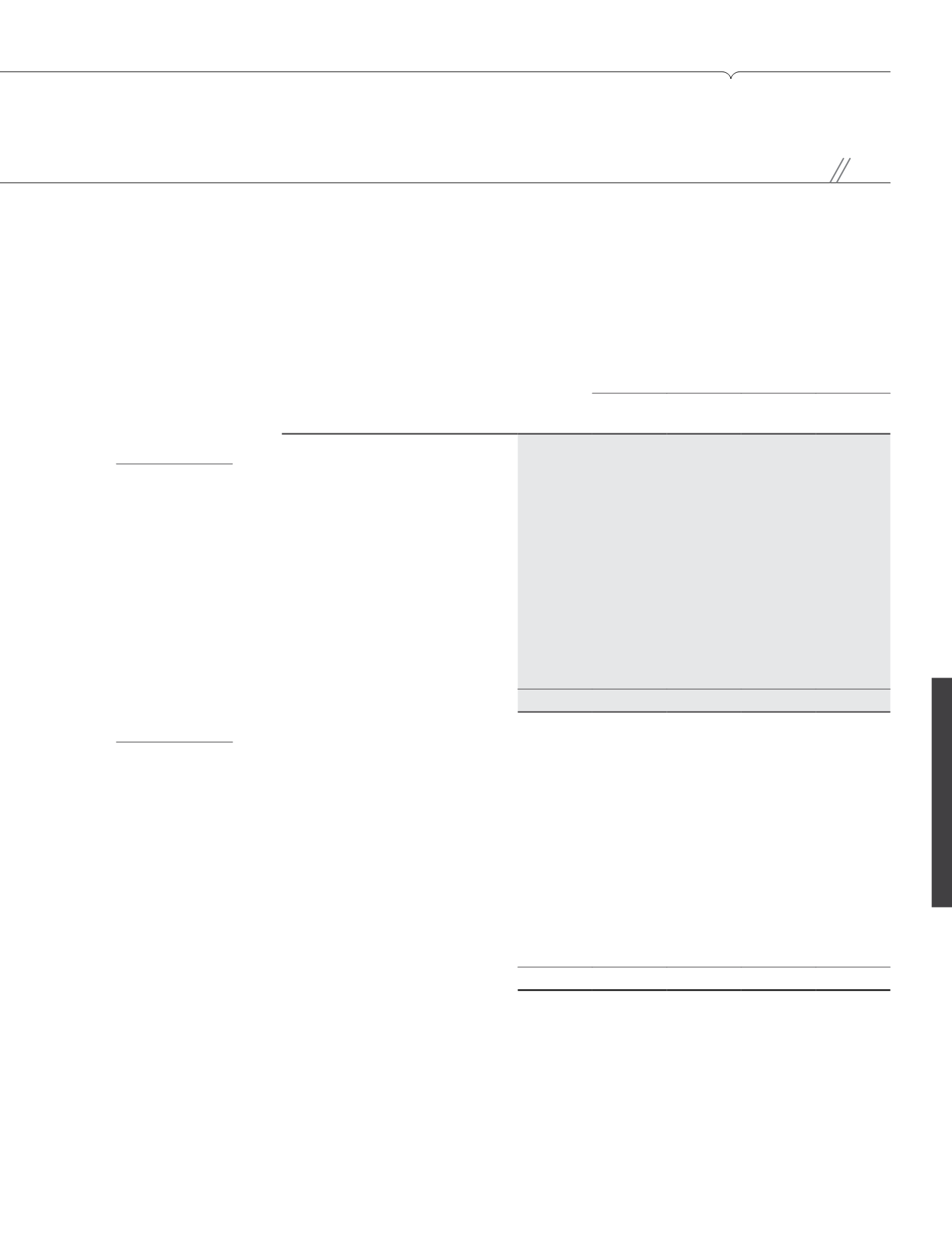

30 BORROWINGS (CONTINUED)

Contractual terms of borrowings (continued)

Company

Contractual

interest rate/

profit margin

at reporting date

(per annum)

%

Functional

currency/

currency

exposure

Total

carrying

amount

RM’000

Maturity profile

< 1 year

RM’000

1-2 years

RM’000

2-5 years

RM’000

> 5 years

RM’000

At 31 December 2015

Unsecured

Syndicated term loans

1.35% - 1.60% + LIBOR

(1)

RM/USD 2,055,764 1,064,080 563,561

428,123

-

Term loans

0.75% + COF

(2)

RM/RM 997,142

-

-

-

997,142

1.50% - 1.60% + LIBOR

(1)

RM/USD 749,801

-

-

-

749,801

1.25% + SOR

(3)

RM/SGD 212,384

-

-

-

212,384

Islamic Medium Term Notes

5.00% - 5.40% RM/RM 3,325,483

-

-

- 3,325,483

Commodity Murabahah Term

Financing

0.70 + COF

(2)

RM/RM 2,516,230

-

-

- 2,516,230

9,856,804 1,064,080 563,561

428,123 7,801,040

At 31 December 2014

Unsecured

Syndicated term loans

1.35% - 1.60% + LIBOR

(1)

RM/USD 2,536,407 865,644 864,056 459,016 347,691

Term loans

0.75% + COF

(2)

RM/RM 996,758

-

-

-

996,758

1.50% - 1.60% + LIBOR

(1)

RM/USD 609,622

-

-

-

609,622

1.25% + SOR

(3)

RM/SGD 184,617

-

-

-

184,617

Islamic Medium Term Notes

5.00% RM/RM 2,484,105

-

-

- 2,484,105

Commodity Murabahah Term

Financing

0.70 + COF

(2)

RM/RM 2,160,669

-

-

- 2,160,669

8,972,178 865,644 864,056 459,016 6,783,462

Notes:

(1)

LIBOR denotes London Interbank Offered Rate.

(2)

COF denotes Cost of Funds.

(3)

SOR denotes Singapore Swap Offer Rate.