Overview Our Business

Strategic Review Corporate Governance

Financial Statements

Other Information

page

141

Notes to the Financial Statements

31 December 2015

30 BORROWINGS (CONTINUED)

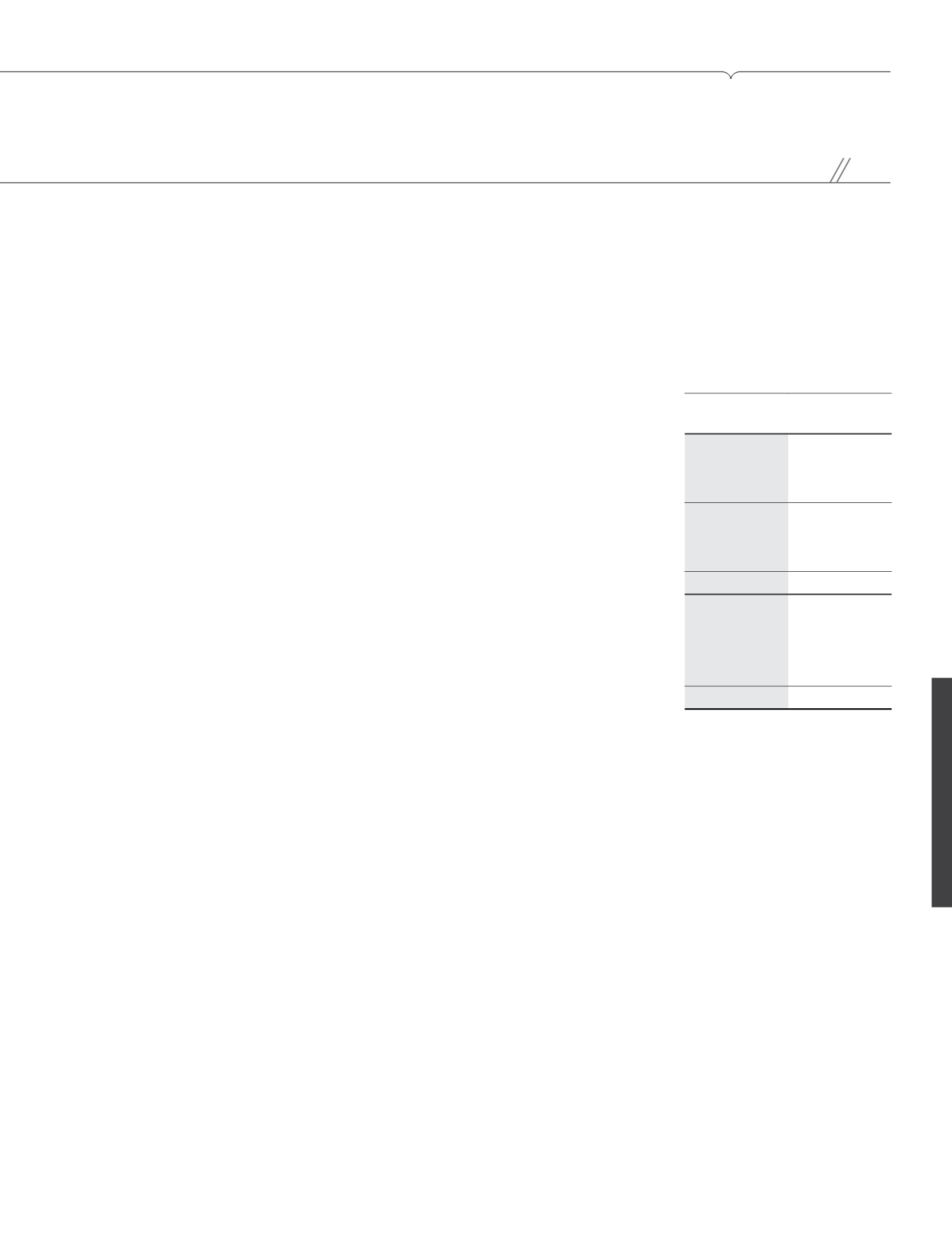

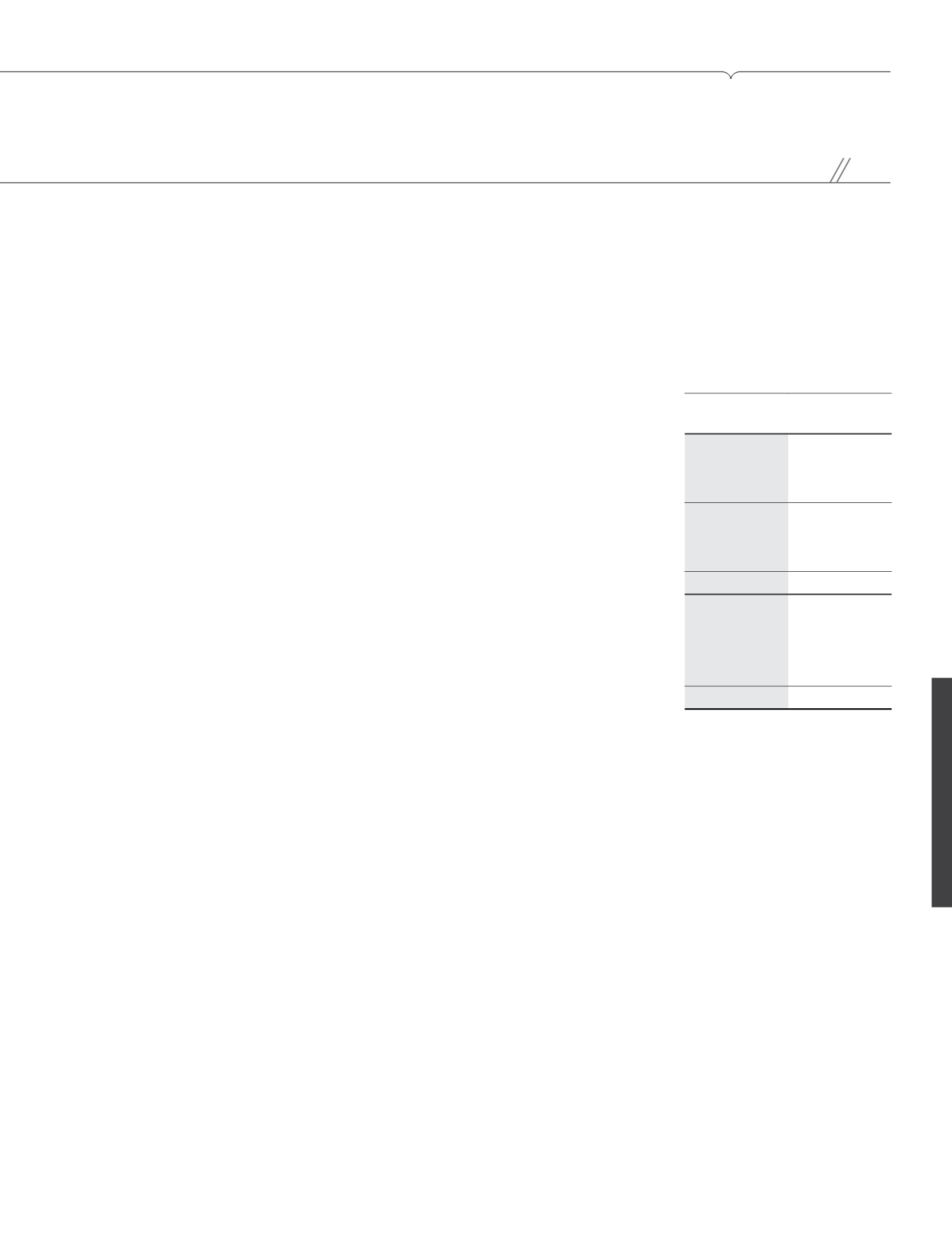

(a) Finance lease liabilities (continued)

Finance lease liabilities represent outstanding obligations payable in respect of assets acquired under finance lease commitment and are

analysed as follows:

Group

2015

RM’000

2014

RM’000

Not later than one year

13,875

15,555

Later than one year and not later than five years

8,384

12,858

22,259

28,413

Less: Future finance charges

(1,411)

(2,507)

Present value

20,848

25,906

Representing lease liabilities:

- non-current

7,980

11,855

- current

12,868

14,051

20,848

25,906

(b) Non-current and current unsecured syndicated term loans

(i)

USD750,000,000 syndicated term loan

This syndicated term loan was drawn down on 24 February 2010 and is repayable in six semi-annual instalments commencing on

24 August 2014 with final maturity on 24 February 2017. During the financial year, two (2014: one) instalments of USD123,750,000

each were repaid. As disclosed in Note 22 to the financial statements, the Company has entered into CCIRS where the principal sum

and interest under this term loan is hedged against fluctuations in USD/RM exchange rate and in LIBOR.

(ii)

USD100,000,000 syndicated term loan

This syndicated term loan was drawn down on 13 August 2010 and is repayable in one lump sum on the loan’s maturity date,

13 August 2020. As disclosed in Note 22 to the financial statements, the Company has entered into CCIRS where the principal sum

and interest under this term loan is hedged against fluctuations in USD/RM exchange rate and in LIBOR.

(c) Non-current unsecured term loans

(i)

RM1,000,000,000 term loan

This term loan was drawn down on 27 December 2011 and is repayable in one lump sum on the loan’s maturity date, 27 December

2022. As disclosed in Note 22 to the financial statements, the Company has entered into IRS where the interest under this term loan

is partially hedged against fluctuations in KLIBOR.