Overview Our Business

Strategic Review Corporate Governance

Financial Statements

Other Information

page

139

Notes to the Financial Statements

31 December 2015

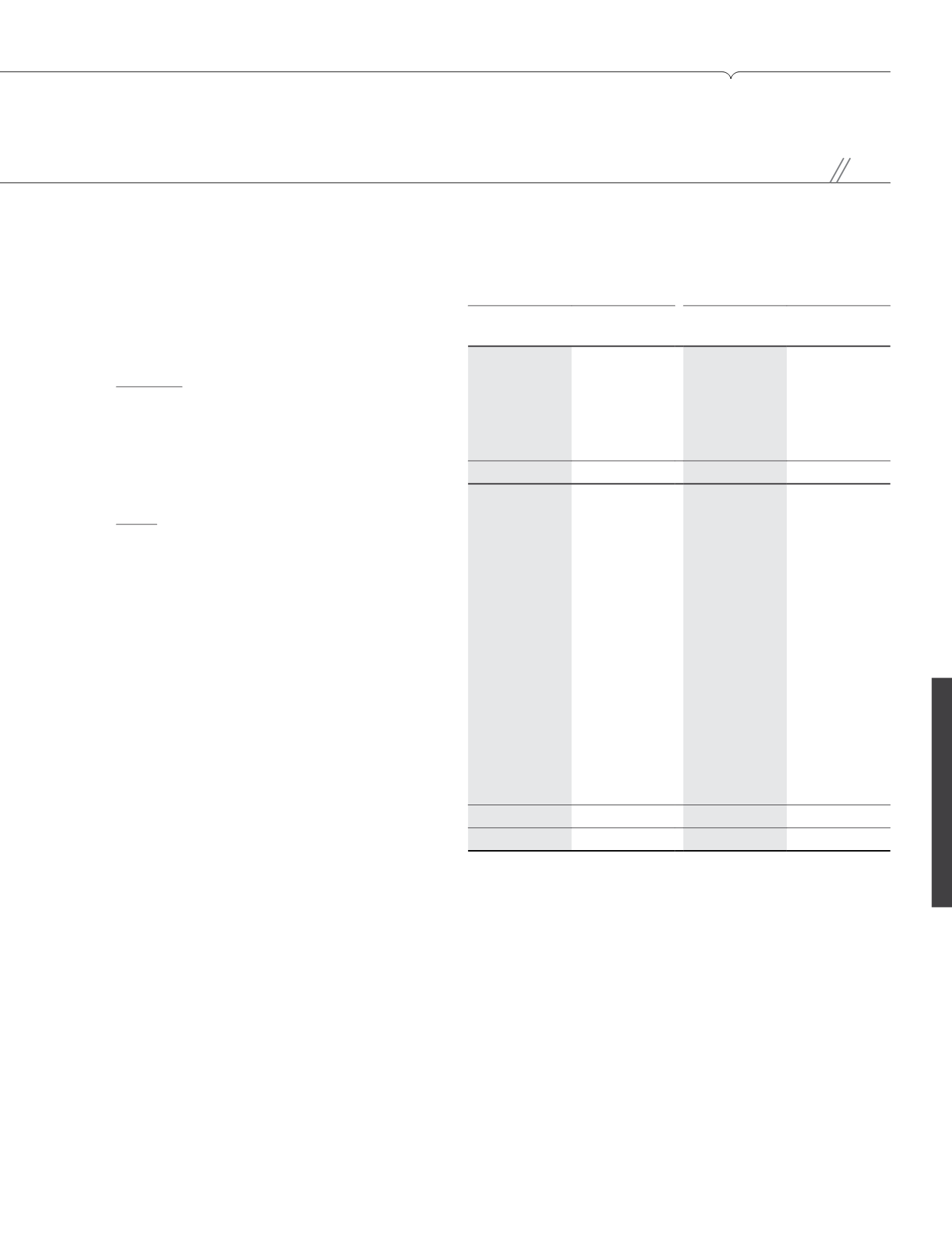

29 PAYABLES AND ACCRUALS

Group

Company

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

Non-current

Trade payables

417,992

448,900

-

-

Other accruals

7,628

4,822

-

-

425,620

453,722

-

-

Current

Intercarrier and roaming payables

125,744

36,507

-

-

Intercarrier and roaming accruals

90,041

93,133

-

-

Subscribers’ deposits

103,324

109,546

-

-

Trade payables

1,539,047

1,100,825

-

-

Trade accruals

383,706

349,995

-

-

Other payables

58,997

116,057

229

284

Other accruals

458,416

507,242

253

609

Advance payments from subscribers

52,385

51,197

-

-

Deferred income

399,145

413,269

-

-

Payroll liabilities

-

12

-

-

Government grant

255,768

223,844

-

-

3,466,573

3,001,627

482

893

3,892,193

3,455,349

482

893

Current trade payables and other payables of the Group and of the Company carry credit periods of up to 90 days (2014: 180 days). The Group’s

current and non-current trade payables include an amount of RM551,101,000 (2014: RM557,323,000), denominated in USD, which is payable

under deferred payment schemes, repayable on a half-yearly basis in 10 to 11 equal instalments commencing from 30 or 36 months from the

commencement dates of the contracts and carry interest rates ranging from 2.43% to 3.03% (2014: 2.19% to 2.56%) per annum as at the

reporting date.

As disclosed in Note 22 to the financial statements, certain payable balances denominated in USD amounting to USD10,000,000 are hedged using

forward foreign exchange contracts against fluctuations in USD/RM exchange rate for which no hedge accounting is applied.

The Group’s other accruals include lease equalisation for office buildings of RM7,737,000 (2014: RM4,885,000) with the remaining lease periods

ranging from 1 year 8 months to 12 years 5 months (2014: 2 years 8 months to 13 years 5 months).