Maxis Berhad

Annual Report 2015

page

144

Notes to the Financial Statements

31 December 2015

30 BORROWINGS (CONTINUED)

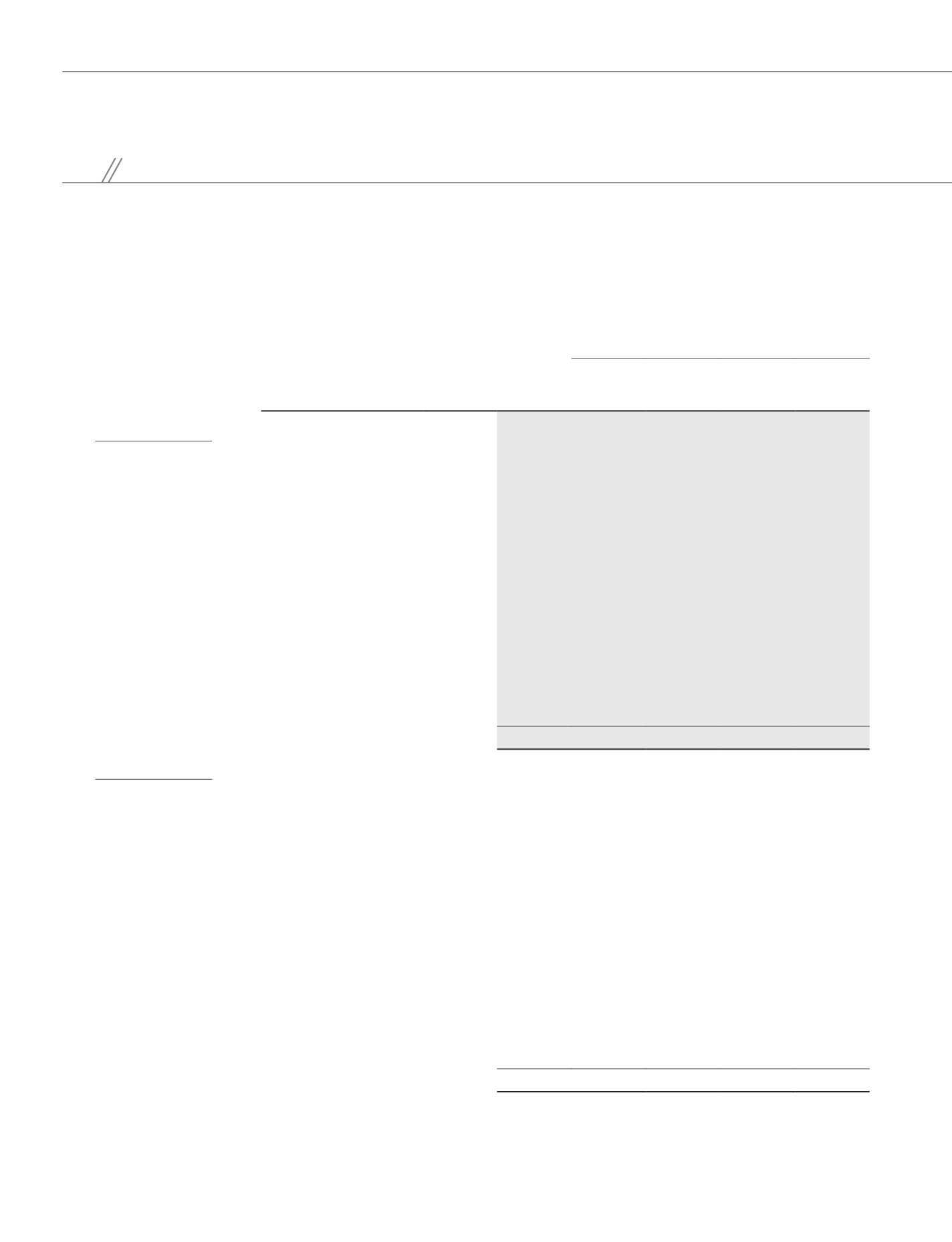

Contractual terms of borrowings

Group

Contractual

interest rate/

profit margin

at reporting date

(per annum)

%

Functional

currency/

currency

exposure

Total

carrying

amount

RM’000

Maturity profile

< 1 year

RM’000

1-2 years

RM’000

2-5 years

RM’000

> 5 years

RM’000

At 31 December 2015

Secured

Finance lease liabilities

RM/RM 20,848

12,868

6,134

1,846

-

Unsecured

Syndicated term loans

1.35% - 1.60% + LIBOR

(1)

RM/USD 2,055,764 1,064,080 563,561

428,123

-

Term loans

0.75% + COF

(2)

RM/RM 997,142

-

-

-

997,142

1.50% - 1.60% + LIBOR

(1)

RM/USD 749,801

-

-

-

749,801

1.25% + SOR

(3)

RM/SGD 212,384

-

-

-

212,384

Islamic Medium Term Notes

5.00% - 5.40% RM/RM 3,325,483

-

-

- 3,325,483

Commodity Murabahah Term

Financing

0.70 + COF

(2)

RM/RM 2,516,230

-

-

- 2,516,230

9,877,652 1,076,948 569,695 429,969 7,801,040

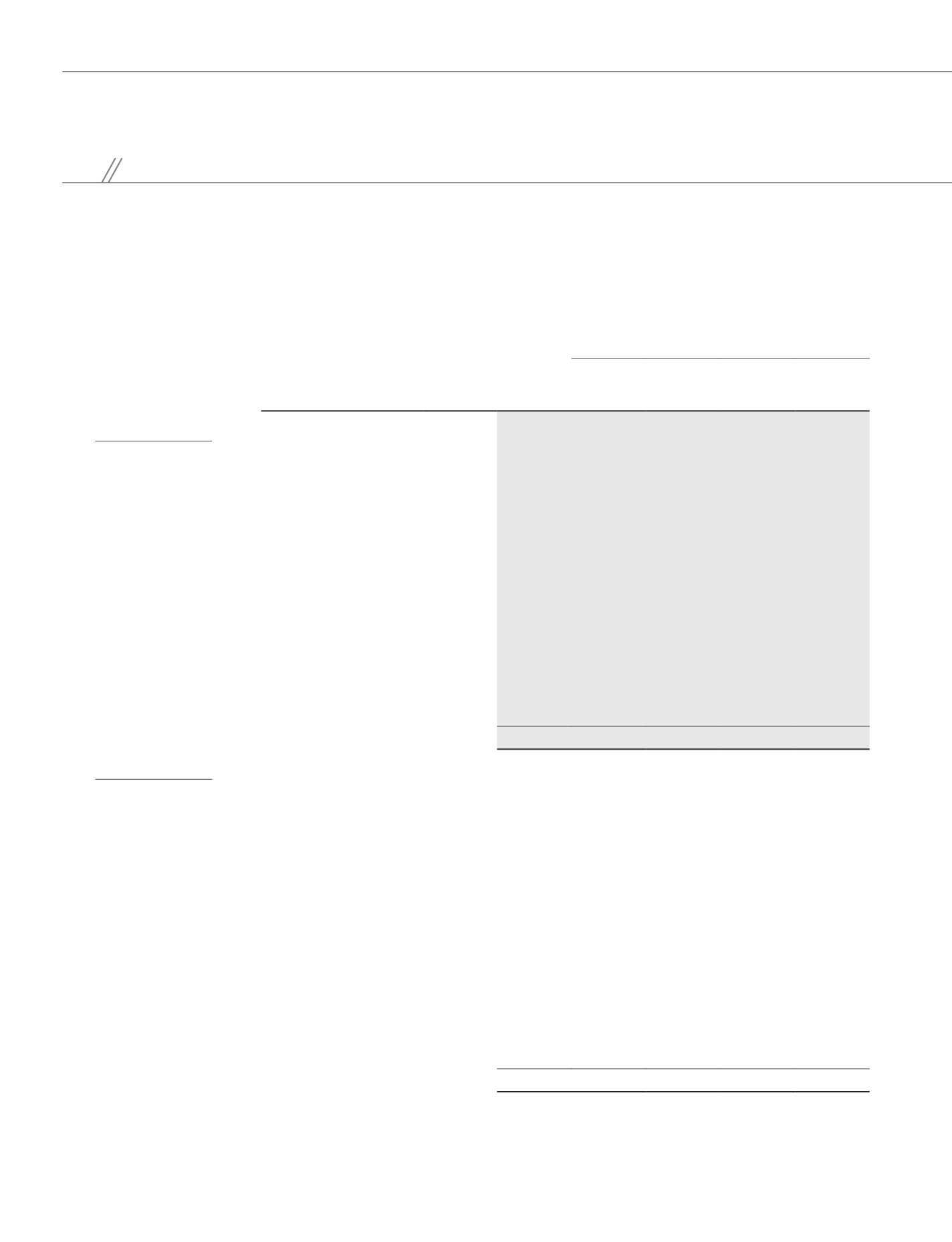

At 31 December 2014

Secured

Finance lease liabilities

RM/RM 25,906

14,051

6,768

5,087

-

Unsecured

Syndicated term loans

1.35% - 1.60% + LIBOR

(1)

RM/USD 2,536,407 865,644 864,056 459,016 347,691

Term loans

0.75% + COF

(2)

RM/RM 996,758

-

-

-

996,758

1.50% - 1.60% + LIBOR

(1)

RM/USD 609,622

-

-

-

609,622

1.25% + SOR

(3)

RM/SGD 184,617

-

-

-

184,617

Islamic Medium Term Notes

5.00% RM/RM 2,484,105

-

-

- 2,484,105

Commodity Murabahah Term

Financing

0.70 + COF

(2)

RM/RM 2,160,669

-

-

- 2,160,669

8,998,084 879,695 870,824 464,103 6,783,462

Notes:

(1)

LIBOR denotes London Interbank Offered Rate.

(2)

COF denotes Cost of Funds.

(3)

SOR denotes Singapore Swap Offer Rate.