Maxis Berhad

Annual Report 2015

page

140

Notes to the Financial Statements

31 December 2015

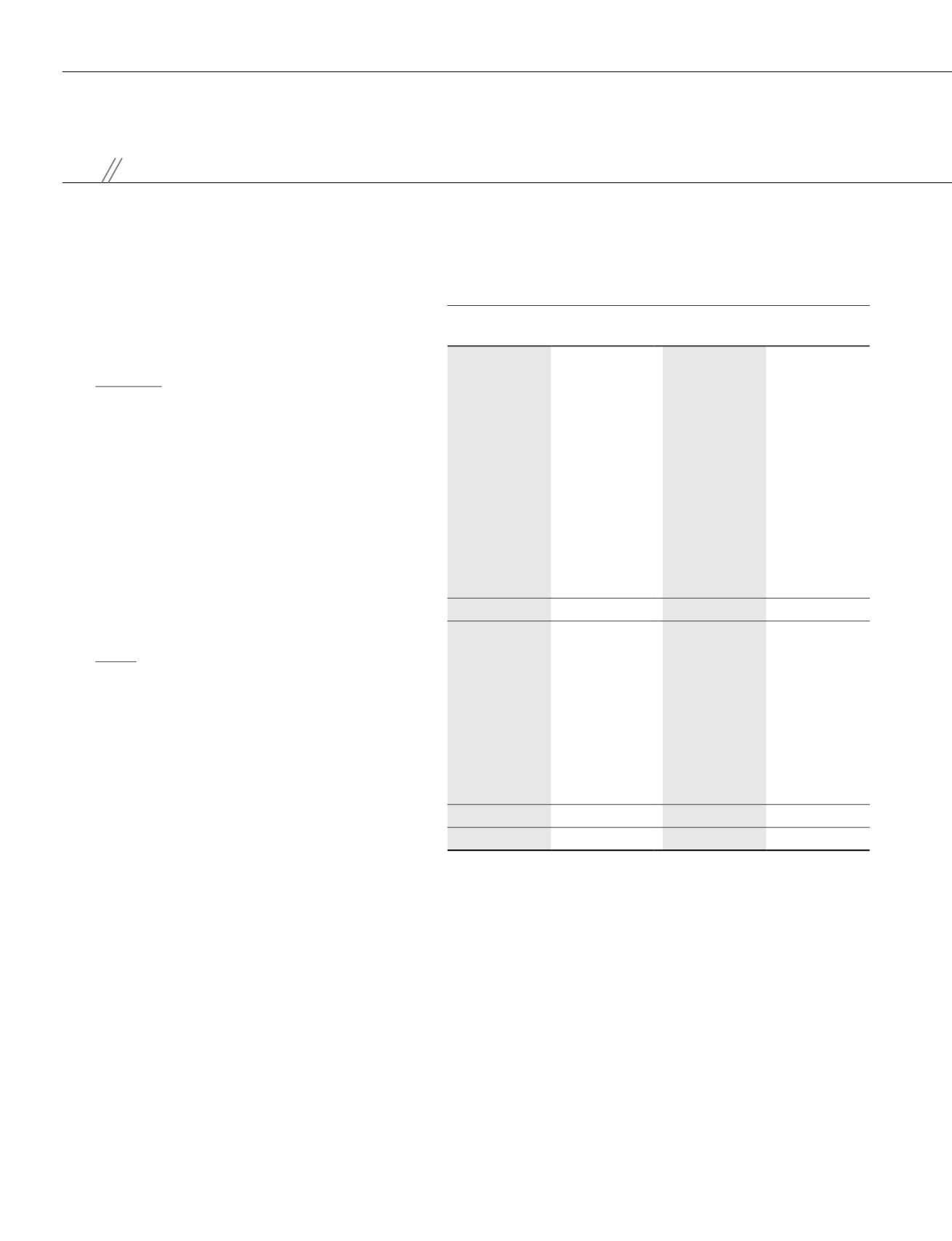

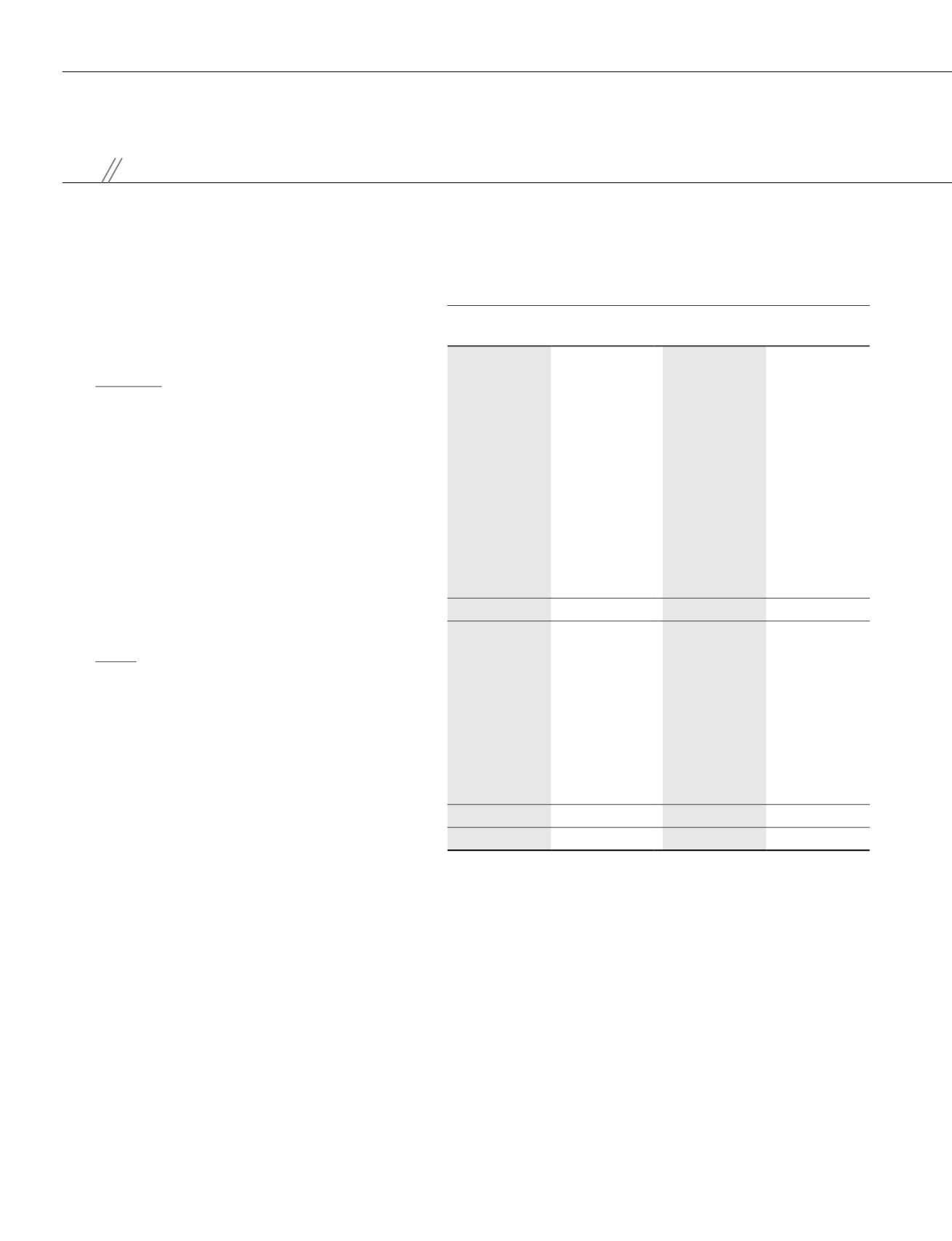

30 BORROWINGS

Group

Company

Note

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

Non-current

Secured

Finance lease liabilities

(a)

7,980

11,855

-

-

Unsecured

Syndicated term loans

(b)

991,684

1,670,763

991,684

1,670,763

Term loans

(c)

1,959,327

1,790,997

1,959,327

1,790,997

Islamic Medium Term Notes

(d)

3,325,483

2,484,105

3,325,483

2,484,105

Commodity Murabahah Term Financing

(e)

2,516,230

2,160,669

2,516,230

2,160,669

8,800,704

8,118,389

8,792,724

8,106,534

Current

Secured

Finance lease liabilities

(a)

12,868

14,051

-

-

Unsecured

Syndicated term loan

(b)

1,064,080

865,644

1,064,080

865,644

1,076,948

879,695

1,064,080

865,644

9,877,652

8,998,084

9,856,804

8,972,178

(a) Finance lease liabilities

The Group leased certain assets under finance lease with terms of three to five years (2014: three to five years). The finance leases have

remaining terms of one to four years (2014: one to three years) which the Group has options for another one to five years extension subject

to renewal conditions by the lessor for certain leased assets.

The weighted average effective interest rate of the Group’s finance lease liabilities is 10.00% (2014: 10.13%) per annum. These leases are

effectively secured as the rights to the leased assets revert to the lessor in the event of defaults.