Overview Our Business

Strategic Review Corporate Governance

Financial Statements

Other Information

page

117

Notes to the Financial Statements

31 December 2015

15 PROPERTY, PLANT AND EQUIPMENT (CONTINUED)

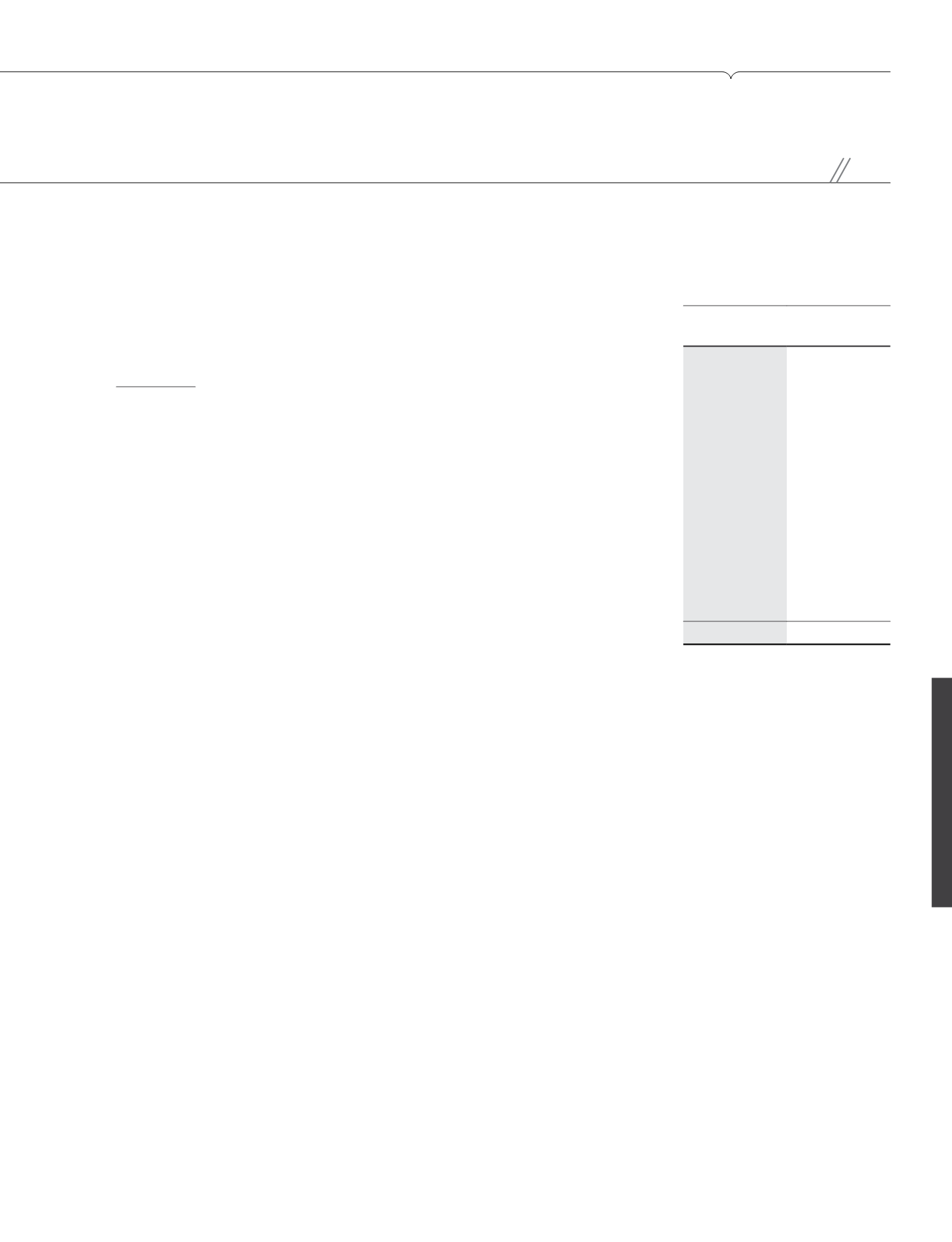

Group

2015

RM’000

2014

RM’000

Net book value

Long-term leasehold land

2,880

2,916

Short-term leasehold land

2,983

3,065

Freehold land

18,260

18,260

Buildings

63,793

65,791

Telecommunications equipment

3,197,279

3,034,770

Motor vehicles

7,197

4,651

Office furniture, fittings and equipment

416,162

426,538

Capital work-in-progress

507,886

433,804

Capital inventories

10,812

19,016

4,227,252

4,008,811

Capital work-in-progress is reclassified to the respective categories of property, plant and equipment on completion.

During the financial year, reversals of impairment of property, plant and equipment for capital inventories amounting to RM532,000 (2014:

RM1,165,000) (included within network operation costs in the statement of profit or loss) were made, upon identification of their planned usage.

During the financial year, the Group had written off property, plant and equipment, net of adjustment, of RM29,755,000 (2014: RM14,770,000)

arising from decommissioning of assets and discontinuing of projects.

For the current financial year, the Group revised the useful lives of certain telecommunications equipment and office equipment ranging from 2

years to 10 years to a remaining useful lives ranging from 1 month to 5 years as part of the network and information technology modernisation

programmes to support the business. The revision was accounted as a change in accounting estimate and as a result, the depreciation charge for

the current financial year has increased by RM81,333,000.

For the financial year ended 31 December 2014, the Group revised the useful lives of certain telecommunications equipment ranging from 2 years

to 20 years to a remaining useful lives ranging from 1 month to 8 years as part of the network modernisation programme to support the business.

The revision was accounted as a change in accounting estimate and as a result, the depreciation charge for the financial year ended 31 December

2014 had increased by RM260,585,000.