Overview Our Business

Strategic Review Corporate Governance

Financial Statements

Other Information

page

121

Notes to the Financial Statements

31 December 2015

17 INTEREST IN SUBSIDIARIES (CONTINUED)

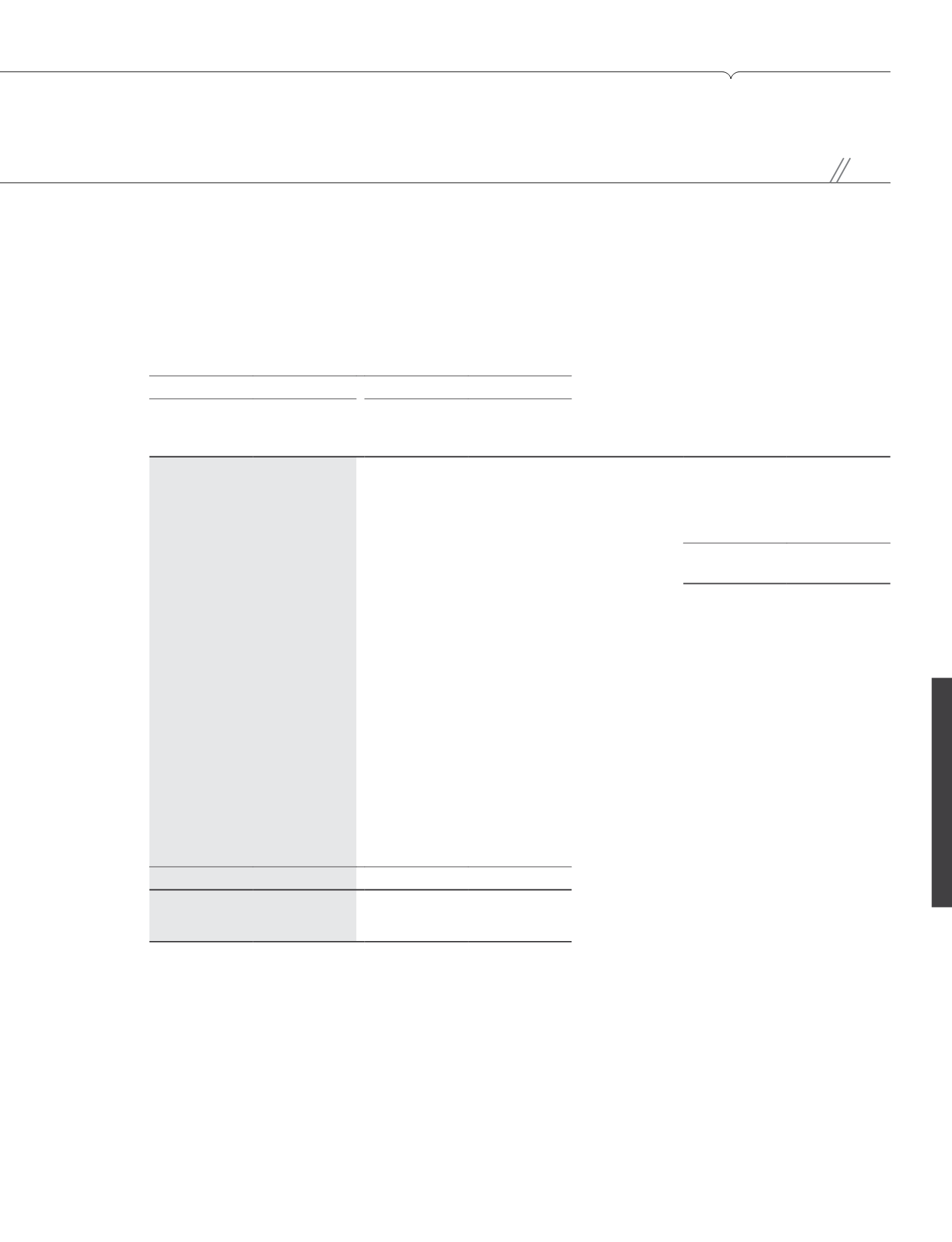

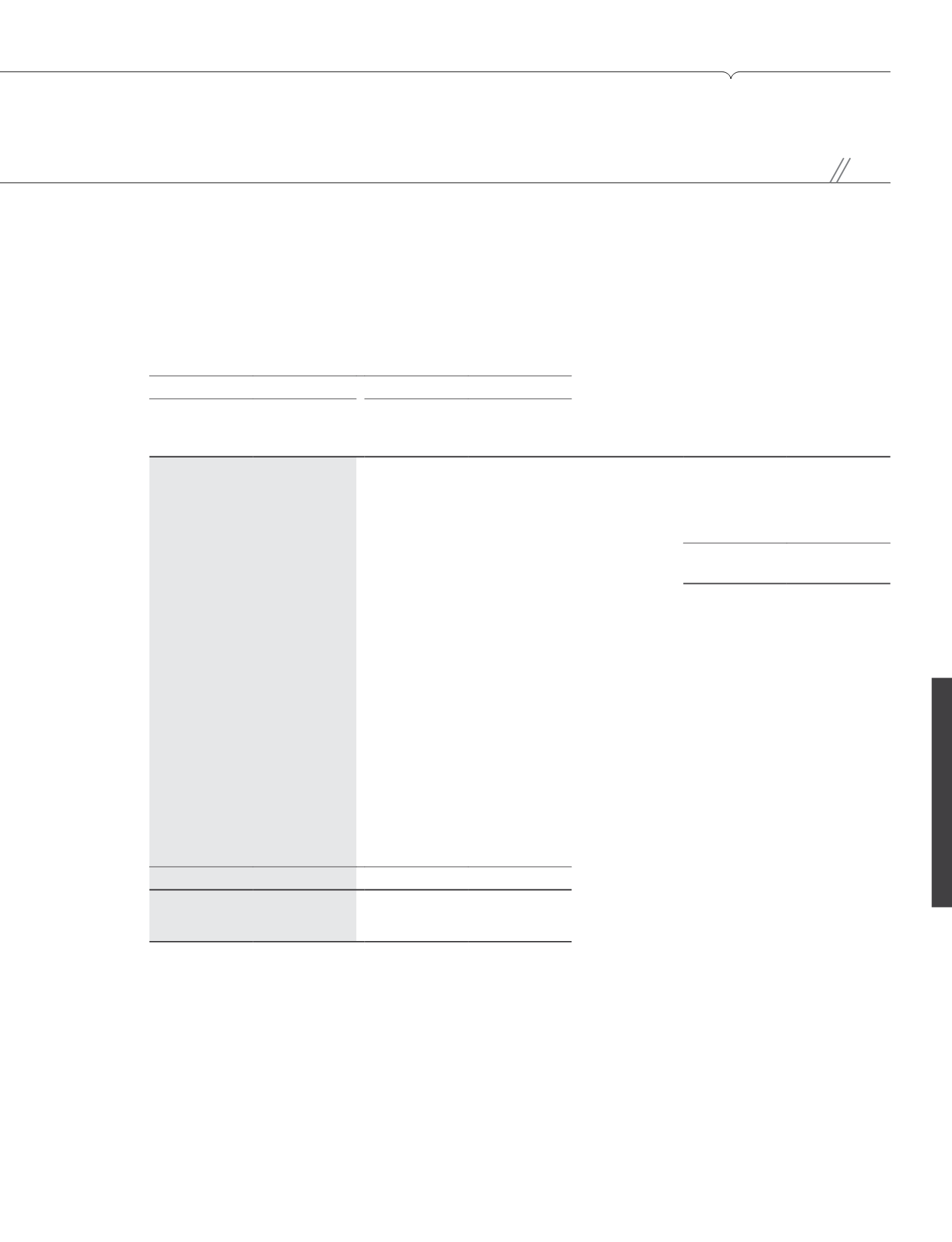

(a) Loans to/(from) subsidiaries - Interest bearing

The terms of the loans are as follows:

Company

2015

2014

Principal

amount

RM’000

Loans out-

standing

RM’000

Principal

amount

RM’000

Loans out-

standing

RM’000

Currency

denomination Repayment terms

1,200,000

366,795

1,200,000

1,205,763

RM The loan is repayable based on a

scheduled repayment as below:

Months after the

first drawdown

Instalment

%

72

27.8

78

35.1

84

37.1

During the financial year, the Company

early settled a portion of the loan

amounting to RM835,000,000, of

which RM605,000,000 was set-off

against loans from a subsidiary. The

remaining loan is repayable in 72

months after the first drawdown.

270,000

270,000

-

-

RM The loan is repayable one year after

the drawdown date.

1,470,000

636,795

1,200,000

1,205,763

-

-

(400,000)

(400,000)

RM During the financial year, these loans

were set-off against loan to a

subsidiary.

The loans to/(from) subsidiaries are unsecured and carry interest rates ranging from 5.00% to 5.63% (2014: 5.00% to 5.18%) per annum

as at the reporting date.

(b) Amounts due from/(to) subsidiaries - Non-interest bearing

The amounts due from/(to) subsidiaries are unsecured and with 30 days credit period (2014: 30 days).