Maxis Berhad

Annual Report 2015

page

126

Notes to the Financial Statements

31 December 2015

21 RECEIVABLES, DEPOSITS AND PREPAYMENTS (CONTINUED)

(a) Trade receivables (continued)

Other than the above, the Group’s credit policy provides trade receivables with credit periods of up to 60 days (2014: up to 60 days). The

Group has no significant exposure to any individual customer, geographical location or industry category. Significant credit and recovery

risks associated with receivables have been provided for in the financial statements.

Given the varied nature of the Group’s customer base, the following analysis of trade receivables by type of customer is considered the most

appropriate disclosure of credit concentrations.

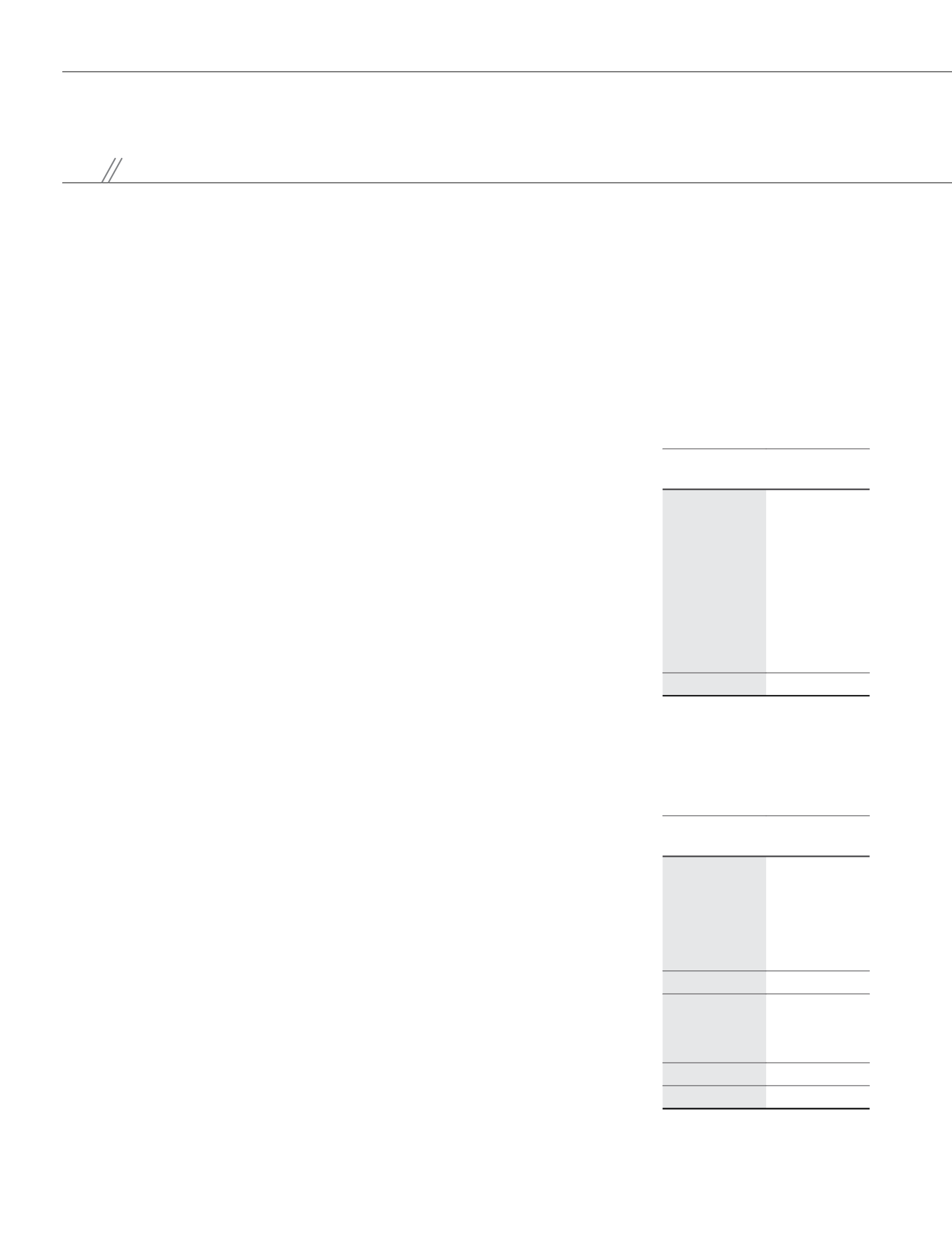

Group

2015

RM’000

2014

RM’000

Subscribers:

- individual

424,787

308,484

- corporate

161,052

139,753

Interconnect and roaming:

- domestic

105,409

86,700

- international

55,941

32,139

Distributors

37,911

57,807

785,100

624,883

Trade receivables are secured by subscribers’ deposits and bank guarantees of RM35,160,000 (2014: RM32,137,000) and RM37,950,000

(2014: RM50,950,000) respectively.

The ageing analysis of the Group’s gross trade receivables is as follows:

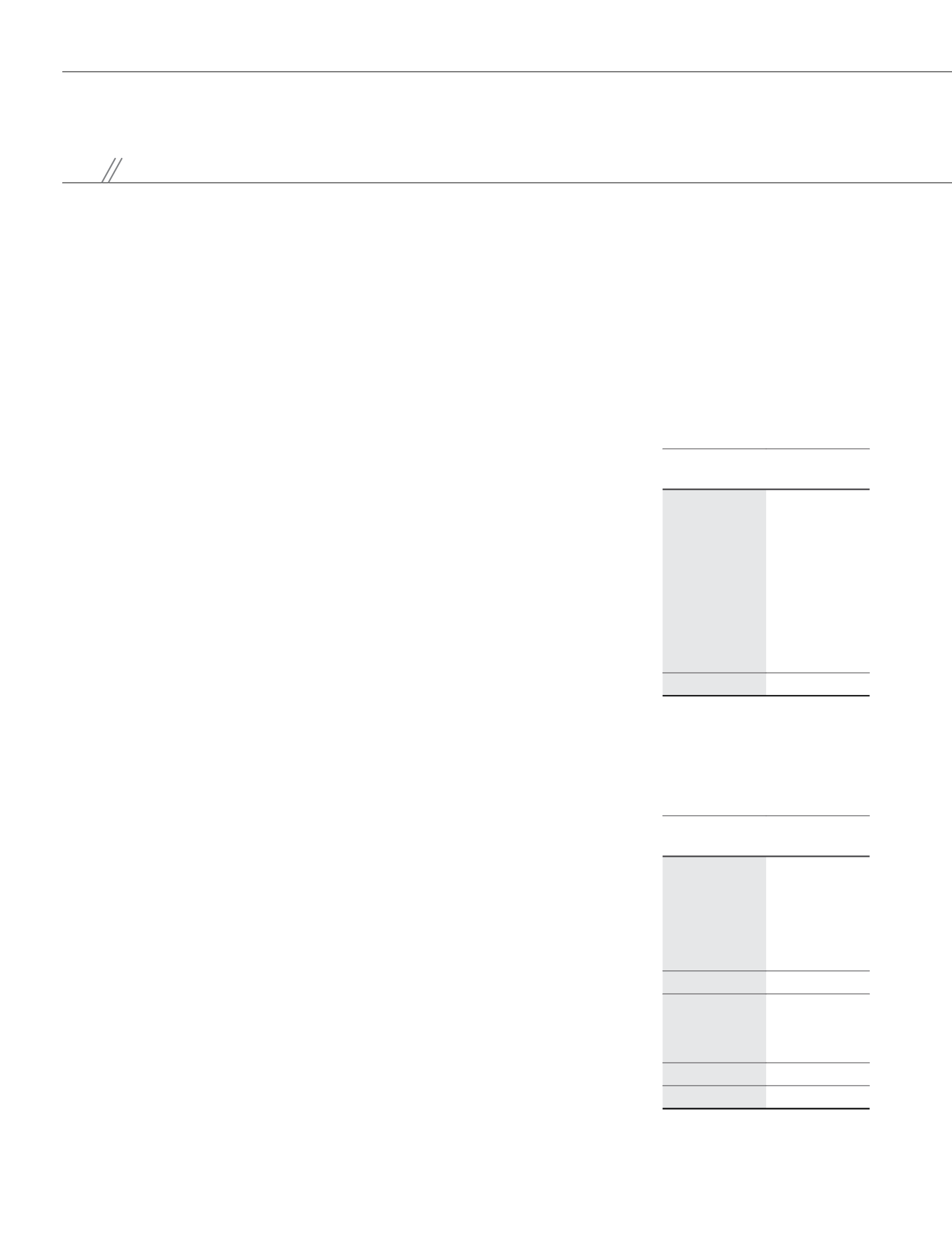

Group

2015

RM’000

2014

RM’000

Neither past due nor impaired

642,645

475,289

1 to 90 days past due not impaired

6,255

9,340

91 to 180 days past due not impaired

2,017

637

More than 180 days past due not impaired

227

220

651,144

485,486

Impaired

(1)

:

- collectively

105,938

105,094

- individually

(2)

28,018

34,303

133,956

139,397

785,100

624,883

Notes:

(1)

Represents gross trade receivables which have been either partially or fully impaired.

(2)

Individually impaired due to default in payment terms.