Maxis Berhad

Annual Report 2015

page

70

EMPLOYEE SHARE OPTION SCHEME (“ESOS”) AND LONG-TERM INCENTIVE PLAN (“LTIP”) (CONTINUED)

(a) ESOS (CONTINUED)

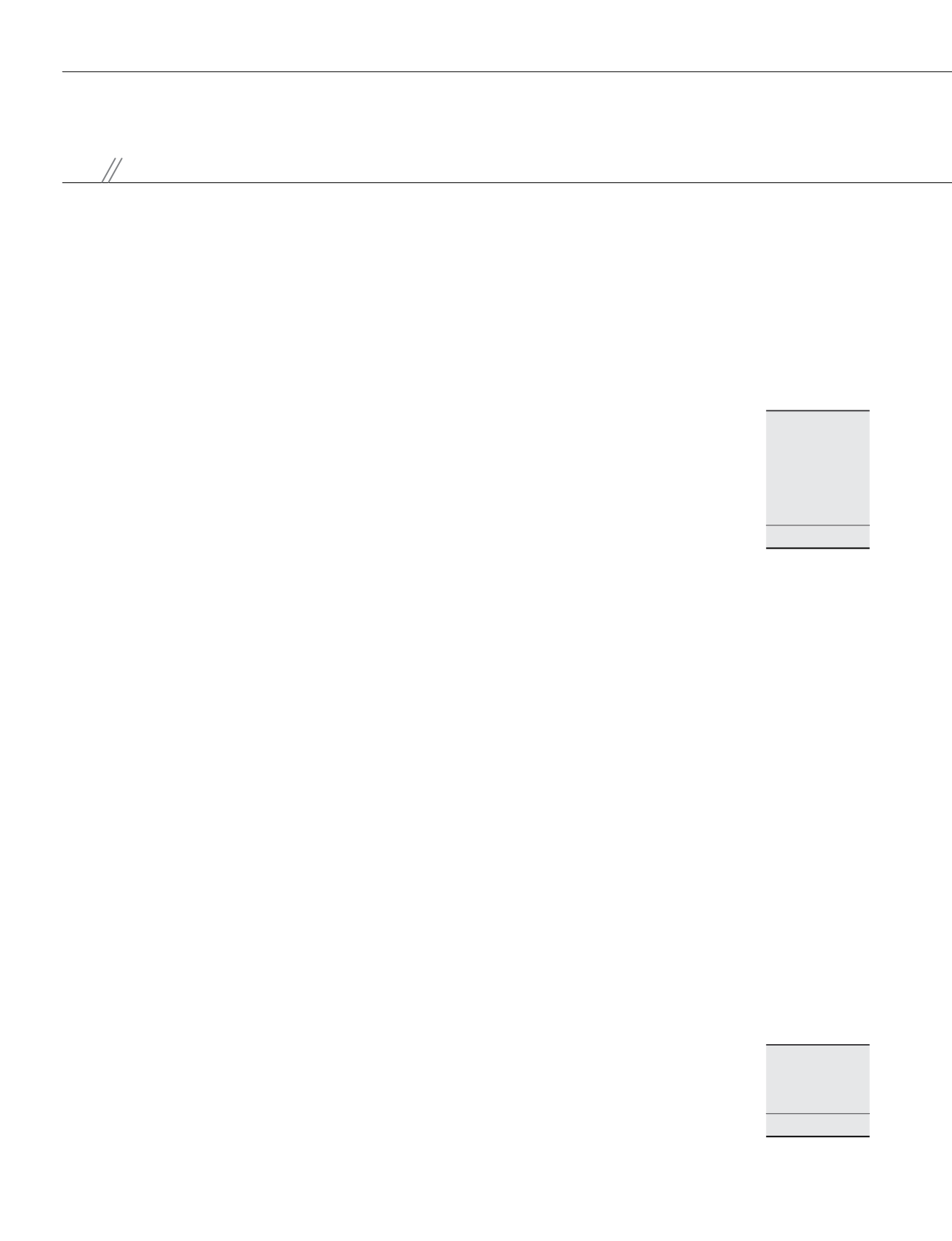

During the financial year, 69,622,800 new share options under the ESOS were granted to the employees of the Group. The movement of the total

share options issued under the ESOS is as follows:

Quantity

’000

Total outstanding as at 1 January 2015

33,859

Total granted

69,623

Total exercised

(3,395)

Total forfeited/lapsed

(3,290)

Total outstanding as at 31 December 2015

96,797

(b) LTIP

The Company’s LTIP is governed by the By-Laws which was approved by the shareholders on 28 April 2015 and is administered by the ESOS/

LTIP Committee which is appointed by the Board of Directors of the Company, in accordance with the By-Laws. The ESOS/LTIP Committee may

from time to time, offer LTIP to eligible employees (including an executive director) of the Group and includes any person who is proposed to be

employed as an employee of the Group (including an executive director).

The maximum number of new shares which may be made available under the LTIP and/or allotted and issued upon vesting of the new shares

under the LTIP shall not, when aggregated with the total number of new shares allotted and issued and/or to be allotted and issued under the

existing ESOS, exceed 250,000,000 shares at any point of time during the duration of the LTIP.

The LTIP comprises a Performance Share Grant (“PS Grant”) and a Restricted Share Grant (“RS Grant”) which shall be in force for a period of

10 years commencing from the effective date of the implementation of the LTIP. The LTIP took effect on 31 July 2015.

Details of the LTIP are disclosed in Note 31(c) to the financial statements.

During the financial year, 8,376,000 PS Grant under the LTIP were granted to the eligible employees of the Group. Subject to the terms and

conditions of the By-Laws governing the LTIP, the employees shall be entitled to receive new ordinary share of RM0.10 each in the Company, to

be allotted and issued pursuant to the LTIP (“new shares”), upon vesting of the new shares after meeting the vesting conditions as set out in the

letter of offer for the shares under the LTIP. The vesting conditions comprising, amongst others, the performance targets and/or conditions for the

period commencing from 1 January 2015 and ending on 31 December 2017, as stipulated by ESOS/LTIP Committee. The vesting date is on 30

April 2018, subject to meeting such performance targets.

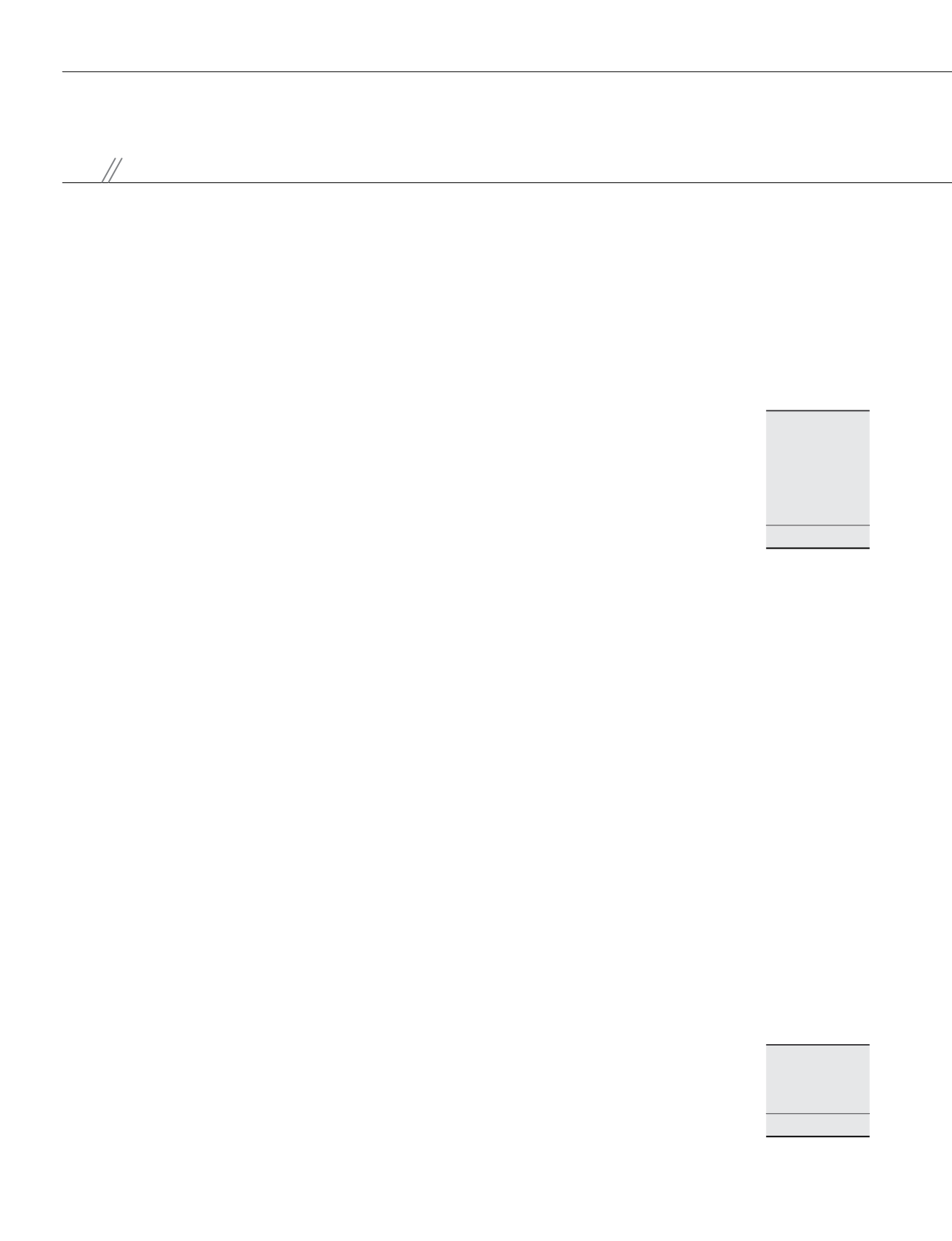

The movement of the PS Grant under the LTIP is as follows:

Quantity

’000

Total granted

8,376

Total forfeited

(91)

Total outstanding as at 31 December 2015

8,285

Directors’ Report