Delivered earnings in line with guidance amid a challenging market environment; the high demand for data and unmatched customer experience continued to drive financial and operational progress.

DELIVERED EARNINGS

IN LINE WITH GUIDANCE

Service Revenue

RM8.5 billion

Normalised EBITDA

RM4.5 billion

Normalised Profit After Tax

RM2.0 billion

Normalised Free Cash Flow

RM1.6 billion

Cash Dividends

RM1.5 billion

HIGH PERFORMING DATA NETWORK

88%

industry-leading 4G LTE population coverage with consistent 4G download speeds

7x LTE

traffic growth; consistent great Internet experience

95%

4G data sessions at 3Mbps or higher; sufficient for seamless HD video streaming

COMMITTED TO DELIVER UNMATCHED CUSTOMER EXPERIENCE

90%

first contact resolution across all customer service touchpoints

60%

customer interactions over digital and self-care platforms

Financial Review

For financial year ended 31 December 2016, despite facing a challenging year, we are pleased to report that we achieved good results and delivered earnings in line with guidance. Service revenue stood at RM8,455 million, relatively stable year-on-year. High demand for data and unmatched customer experience continued to drive positive financial and operational progress.

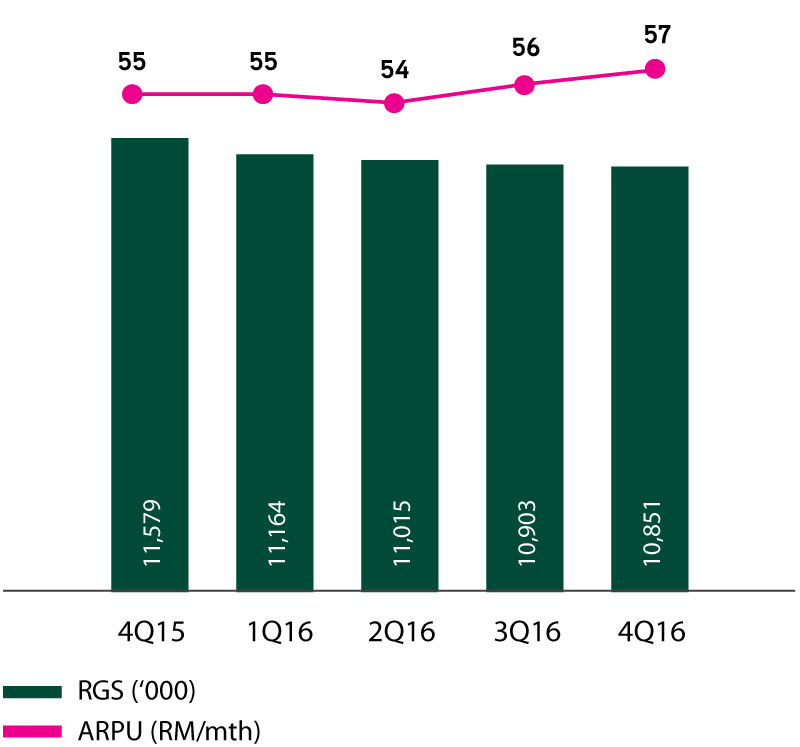

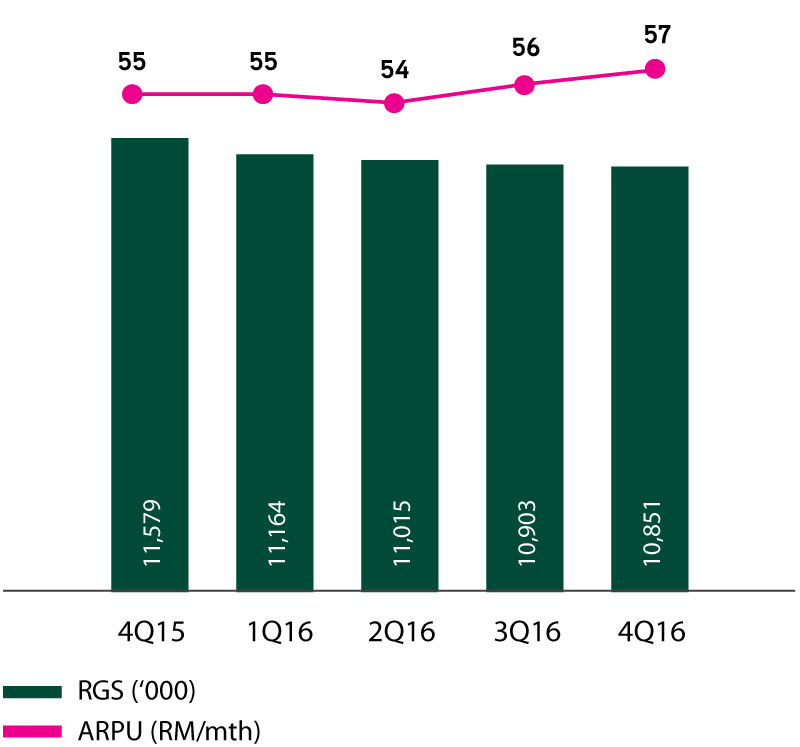

We saw solid performance in mobile data revenue, up 27% year-on-year. This was driven by continuous strong uptake of mobile Internet. Among our 11 million revenue generating subscriptions (“RGS”), 74% are mobile Internet users and 76% are smartphone users.

SERVICE REVENUE (RM mn)

TOTAL RGS AND BLENDED ARPU