Overview

Our Business

Strategic Review Corporate Governance

Financial Statements

Other Information

page

5

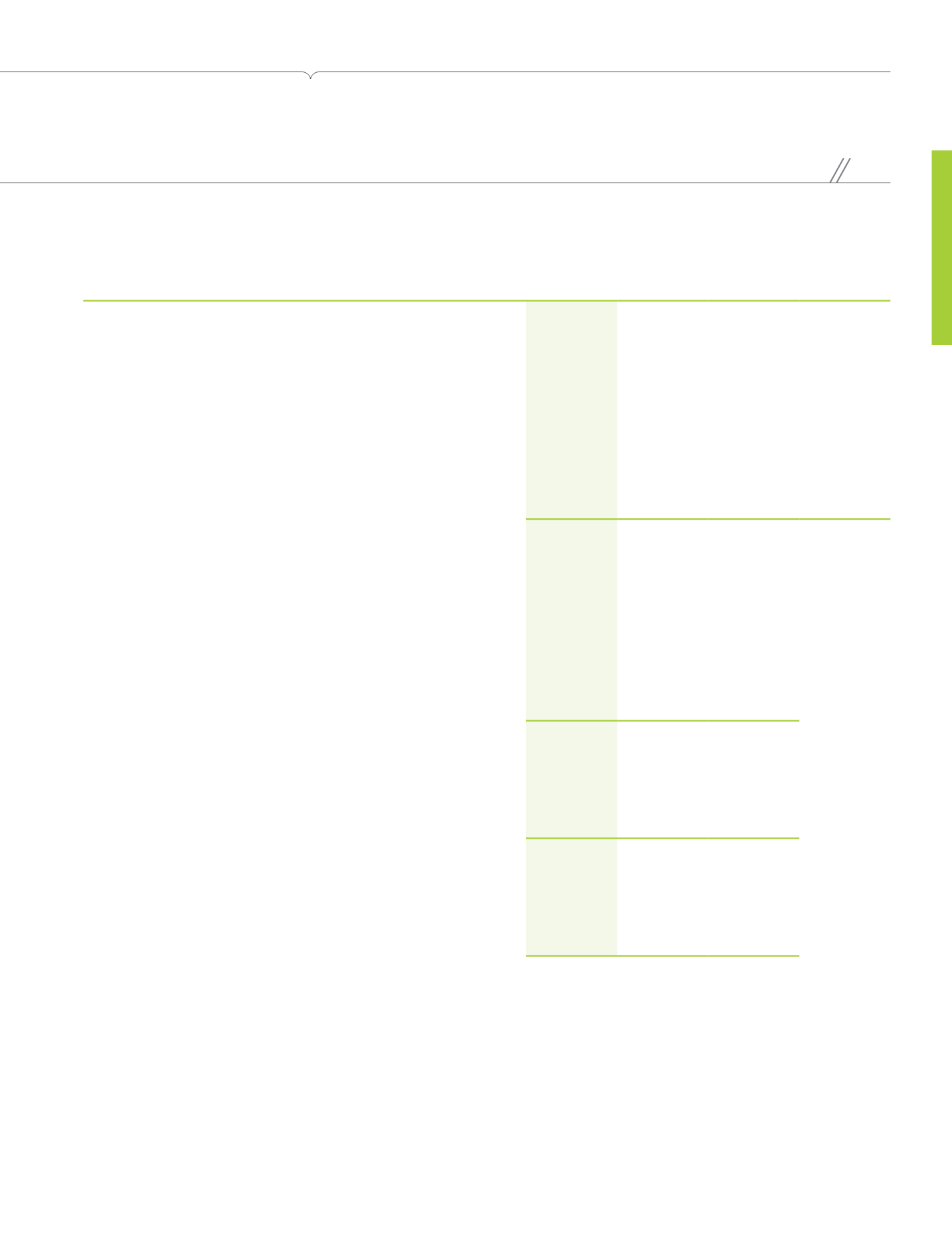

Financial Highlights

2015

2014

(1)

2013

(1)

2014-2015

YoY

Change

FINANCIAL RESULTS

Financial Indicators (RM’m)

Revenue

8,601

8,389

9,084

2.5%

Service revenue

8,539

8,229

8,514

3.8%

EBITDA

4,331

4,229

4,310

2.4%

Normalised EBITDA

(2)

4,425

4,251

4,537

4.1%

Profit from operations

2,872

2,816

2,825

2.0%

Profit Before Tax (“PBT”)

2,460

2,436

2,496

1.0%

Profit After Tax (“PAT”)

1,747

1,725

1,772

1.3%

Normalised PAT

(3)

1,960

1,943

2,110

0.9%

Profit attributable to equity holders of the Company

1,739

1,718

1,765

1.2%

Financial Ratios

EBITDA margin (%)

50.4

50.4

47.4

Normalised EBITDA margin (%)

51.5

50.7

49.9

PBT margin (%)

28.6

29.0

27.5

PAT margin (%)

20.3

20.6

19.5

Normalised PAT margin (%)

22.8

23.2

23.2

Interest cover ratio

6.1

6.6

7.9

Earnings per share (sen)

- basic

23.2

22.9

23.5

- fully diluted

23.2

22.9

23.5

Dividends per share (sen)

(4)

20.0

40.0

40.0

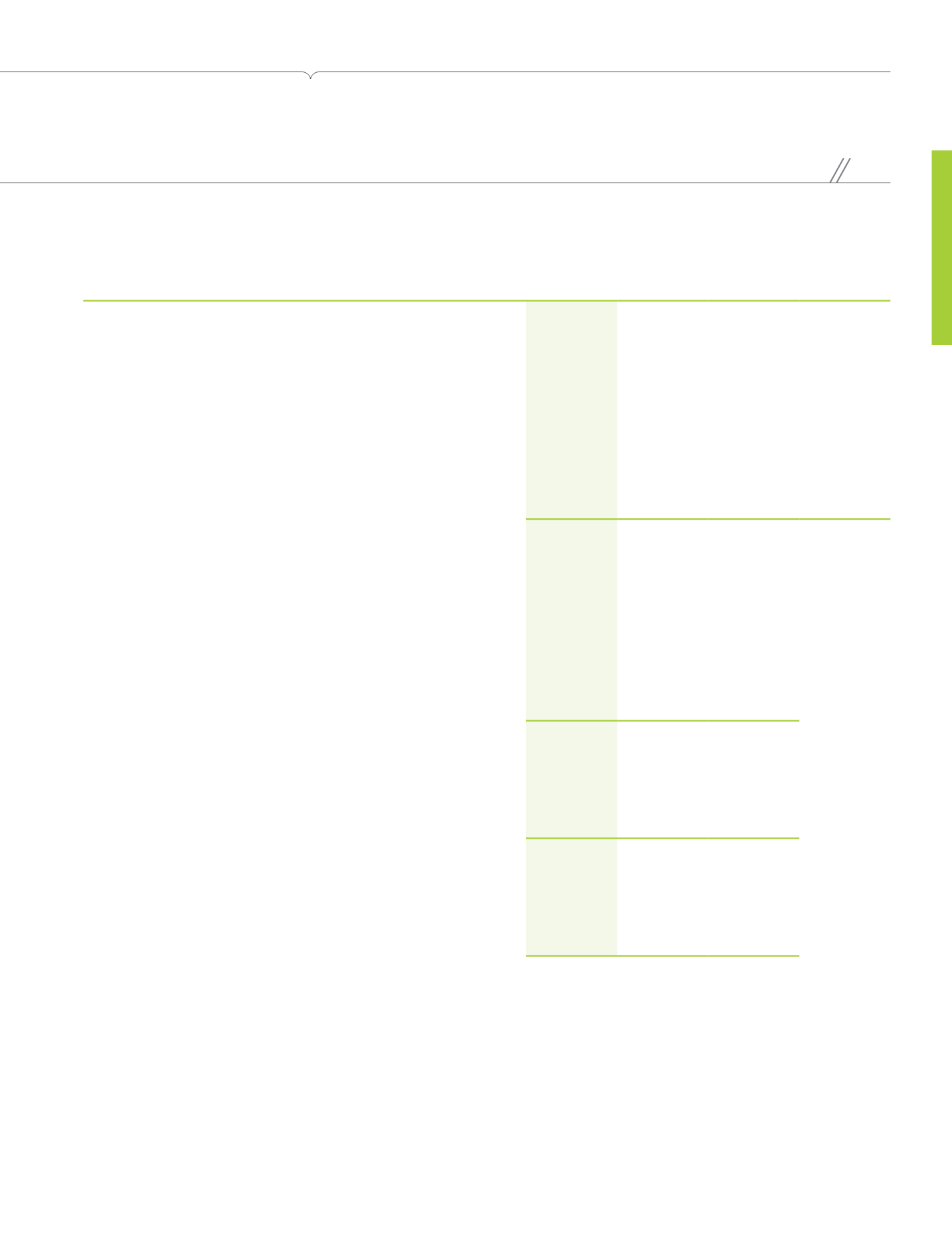

FINANCIAL POSITIONS

Financial Indicators (RM’m)

Equity attributable to equity holders of the Company

4,190

4,716

6,002

Total assets

18,984

18,109

17,330

Total borrowings

9,130

8,798

7,525

Financial Ratios

Return on Invested Capital (%)

17.9

16.9

16.1

Return on Average Equity (%)

39.1

32.1

27.1

Return on Average Assets (%)

11.8

12.0

12.0

Gearing ratio

1.86

1.53

1.12

Net assets per share attributable to equity holders of the Company (RM)

0.56

0.63

0.80

Notes:

(1)

The comparative results were restated to provide more comparable information with the current year.

(2)

Exclude below items for the respective years:

(a) Year 2015 - unrealised foreign exchange losses of RM94 million

(b) Year 2014 - RM22 million comprising unrealised foreign exchange losses of RM44 million offset by reversal of contract obligations of RM22 million

(c) Year 2013 - RM227 million comprising (i) Career Transition Scheme (“CTS”) costs of RM143 million; (ii) provision for contract obligations of RM65 million; (iii) write down of assets

of RM4 million; and (iv) unrealised foreign exchange losses of RM15 million

(3)

Exclude below items (after tax effects) for the respective years:

(a) Year 2015 - RM213 million comprising accelerated depreciation of RM143 million and unrealised foreign exchange losses of RM70 million

(b) Year 2014 - RM218 million comprising accelerated depreciation of RM201 million and unrealised foreign exchange losses of RM33 million offset by reversal of contract obligations of

RM16 million

(c) Year 2013 - RM338 million comprising (i) CTS costs of RM107 million; (ii) provision for contract obligations of RM49 million; (iii) write down of assets of RM65 million;

(iv) accelerated depreciation of RM104 million; and (v) unrealised foreign exchange losses of RM13 million

(4)

Dividends per share consist of interim and final dividends declared and proposed in respect of the designated financial years.